Form F-1193t - Instructions For The Notice Of Intent To Transfer Florida Renewable Energy Production Tax Credit

ADVERTISEMENT

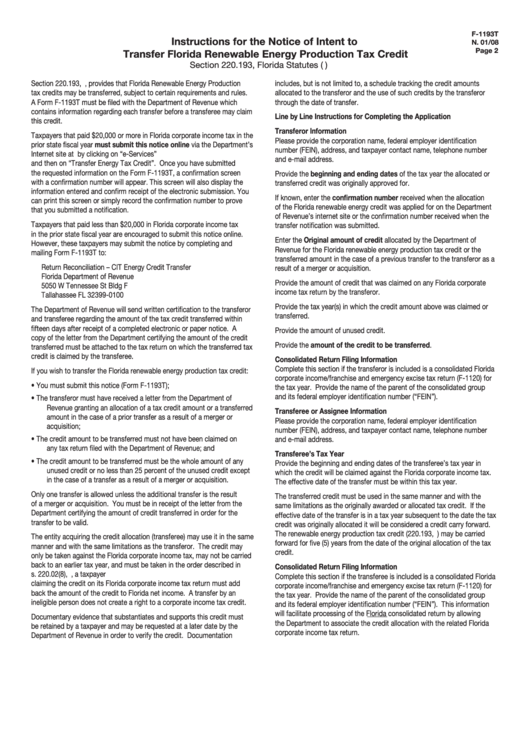

F-1193T

Instructions for the Notice of Intent to

N. 01/08

Page 2

Transfer Florida Renewable Energy Production Tax Credit

Section 220.193, Florida Statutes (F.S.)

Section 220.193, F.S., provides that Florida Renewable Energy Production

includes, but is not limited to, a schedule tracking the credit amounts

tax credits may be transferred, subject to certain requirements and rules.

allocated to the transferor and the use of such credits by the transferor

A Form F-1193T must be filed with the Department of Revenue which

through the date of transfer.

contains information regarding each transfer before a transferee may claim

Line by Line Instructions for Completing the Application

this credit.

Transferor Information

Taxpayers that paid $20,000 or more in Florida corporate income tax in the

Please provide the corporation name, federal employer identification

prior state fiscal year must submit this notice online via the Department’s

number (FEIN), address, and taxpayer contact name, telephone number

Internet site at by clicking on “e-Services”

and e-mail address.

and then on “Transfer Energy Tax Credit”. Once you have submitted

the requested information on the Form F-1193T, a confirmation screen

Provide the beginning and ending dates of the tax year the allocated or

with a confirmation number will appear. This screen will also display the

transferred credit was originally approved for.

information entered and confirm receipt of the electronic submission. You

If known, enter the confirmation number received when the allocation

can print this screen or simply record the confirmation number to prove

of the Florida renewable energy credit was applied for on the Department

that you submitted a notification.

of Revenue’s internet site or the confirmation number received when the

Taxpayers that paid less than $20,000 in Florida corporate income tax

transfer notification was submitted.

in the prior state fiscal year are encouraged to submit this notice online.

Enter the Original amount of credit allocated by the Department of

However, these taxpayers may submit the notice by completing and

Revenue for the Florida renewable energy production tax credit or the

mailing Form F-1193T to:

transferred amount in the case of a previous transfer to the transferor as a

Return Reconciliation – CIT Energy Credit Transfer

result of a merger or acquisition.

Florida Department of Revenue

Provide the amount of credit that was claimed on any Florida corporate

5050 W Tennessee St Bldg F

income tax return by the transferor.

Tallahassee FL 32399-0100

Provide the tax year(s) in which the credit amount above was claimed or

The Department of Revenue will send written certification to the transferor

transferred.

and transferee regarding the amount of the tax credit transferred within

fifteen days after receipt of a completed electronic or paper notice. A

Provide the amount of unused credit.

copy of the letter from the Department certifying the amount of the credit

Provide the amount of the credit to be transferred.

transferred must be attached to the tax return on which the transferred tax

credit is claimed by the transferee.

Consolidated Return Filing Information

Complete this section if the transferor is included is a consolidated Florida

If you wish to transfer the Florida renewable energy production tax credit:

corporate income/franchise and emergency excise tax return (F-1120) for

•

You must submit this notice (Form F-1193T);

the tax year. Provide the name of the parent of the consolidated group

and its federal employer identification number (“FEIN”).

•

The transferor must have received a letter from the Department of

Revenue granting an allocation of a tax credit amount or a transferred

Transferee or Assignee Information

amount in the case of a prior transfer as a result of a merger or

Please provide the corporation name, federal employer identification

acquisition;

number (FEIN), address, and taxpayer contact name, telephone number

•

The credit amount to be transferred must not have been claimed on

and e-mail address.

any tax return filed with the Department of Revenue; and

Transferee’s Tax Year

•

The credit amount to be transferred must be the whole amount of any

Provide the beginning and ending dates of the transferee’s tax year in

unused credit or no less than 25 percent of the unused credit except

which the credit will be claimed against the Florida corporate income tax.

in the case of a transfer as a result of a merger or acquisition.

The effective date of the transfer must be within this tax year.

Only one transfer is allowed unless the additional transfer is the result

The transferred credit must be used in the same manner and with the

of a merger or acquisition. You must be in receipt of the letter from the

same limitations as the originally awarded or allocated tax credit. If the

Department certifying the amount of credit transferred in order for the

effective date of the transfer is in a tax year subsequent to the date the tax

transfer to be valid.

credit was originally allocated it will be considered a credit carry forward.

The renewable energy production tax credit (220.193, F.S.) may be carried

The entity acquiring the credit allocation (transferee) may use it in the same

forward for five (5) years from the date of the original allocation of the tax

manner and with the same limitations as the transferor. The credit may

credit.

only be taken against the Florida corporate income tax, may not be carried

back to an earlier tax year, and must be taken in the order described in

Consolidated Return Filing Information

s. 220.02(8), F.S. In order to prevent a double tax benefit, a taxpayer

Complete this section if the transferee is included is a consolidated Florida

claiming the credit on its Florida corporate income tax return must add

corporate income/franchise and emergency excise tax return (F-1120) for

back the amount of the credit to Florida net income. A transfer by an

the tax year. Provide the name of the parent of the consolidated group

ineligible person does not create a right to a corporate income tax credit.

and its federal employer identification number (“FEIN”). This information

will facilitate processing of the Florida consolidated return by allowing

Documentary evidence that substantiates and supports this credit must

the Department to associate the credit allocation with the related Florida

be retained by a taxpayer and may be requested at a later date by the

corporate income tax return.

Department of Revenue in order to verify the credit. Documentation

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1