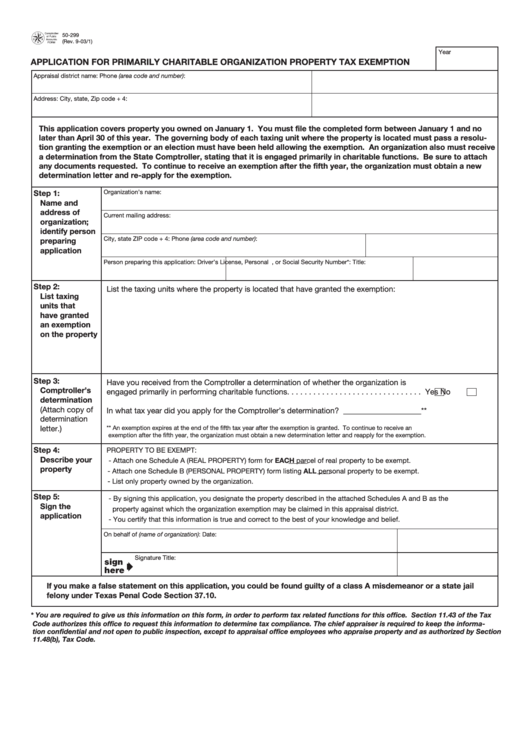

50-299

(Rev. 9-03/1)

Year

APPLICATION FOR PRIMARILY CHARITABLE ORGANIZATION PROPERTY TAX EXEMPTION

Appraisal district name:

Phone (area code and number):

Address:

City, state, Zip code + 4:

This application covers property you owned on January 1. You must file the completed form between January 1 and no

later than April 30 of this year. The governing body of each taxing unit where the property is located must pass a resolu-

tion granting the exemption or an election must have been held allowing the exemption. An organization also must receive

a determination from the State Comptroller, stating that it is engaged primarily in charitable functions. Be sure to attach

any documents requested. To continue to receive an exemption after the fifth year, the organization must obtain a new

determination letter and re-apply for the exemption.

Step 1:

Organization’s name:

Name and

address of

Current mailing address:

organization;

identify person

City, state ZIP code + 4:

Phone (area code and number):

preparing

application

Person preparing this application:

Driver’s License, Personal I.D. Certificate, or Social Security Number*: Title:

Step 2:

List the taxing units where the property is located that have granted the exemption:

List taxing

units that

have granted

an exemption

on the property

Step 3:

Have you received from the Comptroller a determination of whether the organization is

Comptroller’s

engaged primarily in performing charitable functions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

determination

(Attach copy of

In what tax year did you apply for the Comptroller’s determination? ____________________**

determination

letter.)

** An exemption expires at the end of the fifth tax year after the exemption is granted. To continue to receive an

exemption after the fifth year, the organization must obtain a new determination letter and reapply for the exemption.

Step 4:

PROPERTY TO BE EXEMPT:

Describe your

- Attach one Schedule A (REAL PROPERTY) form for EACH parcel of real property to be exempt.

property

- Attach one Schedule B (PERSONAL PROPERTY) form listing ALL personal property to be exempt.

- List only property owned by the organization.

Step 5:

- By signing this application, you designate the property described in the attached Schedules A and B as the

Sign the

property against which the organization exemption may be claimed in this appraisal district.

application

- You certify that this information is true and correct to the best of your knowledge and belief.

On behalf of (name of organization):

Date:

Signature

Title:

If you make a false statement on this application, you could be found guilty of a class A misdemeanor or a state jail

felony under Texas Penal Code Section 37.10.

* You are required to give us this information on this form, in order to perform tax related functions for this office. Section 11.43 of the Tax

Code authorizes this office to request this information to determine tax compliance. The chief appraiser is required to keep the informa-

tion confidential and not open to public inspection, except to appraisal office employees who appraise property and as authorized by Section

11.48(b), Tax Code.

1

1 2

2 3

3