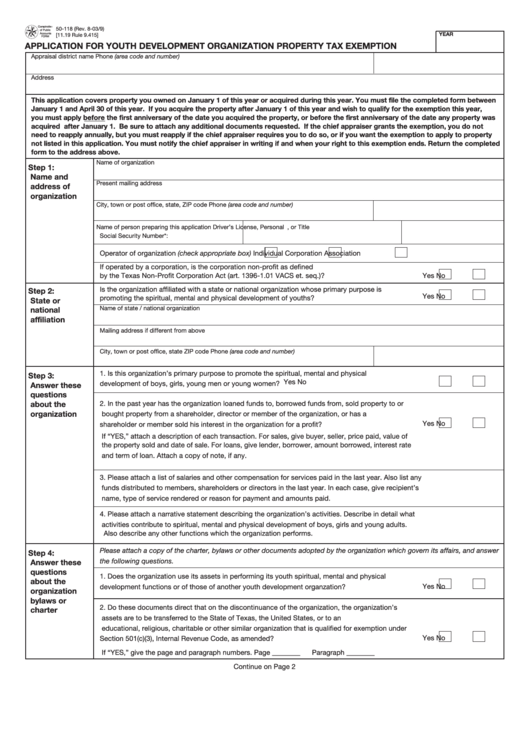

Form 50-118 - Application For Youth Development Organization Property Tax Exemption

ADVERTISEMENT

Comptrolle r

50-118 (Rev. 8-03/9)

T

E

of Public

S

X

YEAR

Accounts

[11.19 Rule 9.415]

A

FORM

APPLICATION FOR YOUTH DEVELOPMENT ORGANIZATION PROPERTY TAX EXEMPTION

Appraisal district name

Phone (area code and number)

Address

This application covers property you owned on January 1 of this year or acquired during this year. You must file the completed form between

January 1 and April 30 of this year. If you acquire the property after January 1 of this year and wish to qualify for the exemption this year,

you must apply before the first anniversary of the date you acquired the property, or before the first anniversary of the date any property was

acquired after January 1. Be sure to attach any additional documents requested. If the chief appraiser grants the exemption, you do not

need to reapply annually, but you must reapply if the chief appraiser requires you to do so, or if you want the exemption to apply to property

not listed in this application. You must notify the chief appraiser in writing if and when your right to this exemption ends. Return the completed

form to the address above.

Name of organization

Step 1:

Name and

Present mailing address

address of

organization

Phone (area code and number)

City, town or post office, state, ZIP code

Name of person preparing this application

Driver’s License, Personal I.D. Certificate, or

Title

Social Security Number*:

Operator of organization (check appropriate box)

Individual

Corporation

Association

If operated by a corporation, is the corporation non-profit as defined

by the Texas Non-Profit Corporation Act (art. 1396-1.01 VACS et. seq.)? ............................................

Yes

No

Is the organization affiliated with a state or national organization whose primary purpose is

Step 2:

Yes

No

promoting the spiritual, mental and physical development of youths? ..................................................

State or

Name of state / national organization

national

affiliation

Mailing address if different from above

City, town or post office, state ZIP code

Phone (area code and number)

1. Is this organization’s primary purpose to promote the spiritual, mental and physical

Step 3:

Yes

No

development of boys, girls, young men or young women? ..............................................................

Answer these

questions

about the

2. In the past year has the organization loaned funds to, borrowed funds from, sold property to or

organization

bought property from a shareholder, director or member of the organization, or has a

Yes

No

shareholder or member sold his interest in the organization for a profit? .........................................

If “YES,” attach a description of each transaction. For sales, give buyer, seller, price paid, value of

the property sold and date of sale. For loans, give lender, borrower, amount borrowed, interest rate

and term of loan. Attach a copy of note, if any.

3. Please attach a list of salaries and other compensation for services paid in the last year. Also list any

funds distributed to members, shareholders or directors in the last year. In each case, give recipient’s

name, type of service rendered or reason for payment and amounts paid.

4. Please attach a narrative statement describing the organization’s activities. Describe in detail what

activities contribute to spiritual, mental and physical development of boys, girls and young adults.

Also describe any other functions which the organization performs.

Please attach a copy of the charter, bylaws or other documents adopted by the organization which govern its affairs, and answer

Step 4:

the following questions.

Answer these

questions

1. Does the organization use its assets in performing its youth spiritual, mental and physical

about the

development functions or of those of another youth development organzation? .............................

Yes

No

organization

bylaws or

2. Do these documents direct that on the discontinuance of the organization, the organization’s

charter

assets are to be transferred to the State of Texas, the United States, or to an

educational, religious, charitable or other similar organization that is qualified for exemption under

Yes

No

Section 501(c)(3), Internal Revenue Code, as amended? ..................................................................

If “YES,” give the page and paragraph numbers.

Page ________

Paragraph ________

Continue on Page 2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4