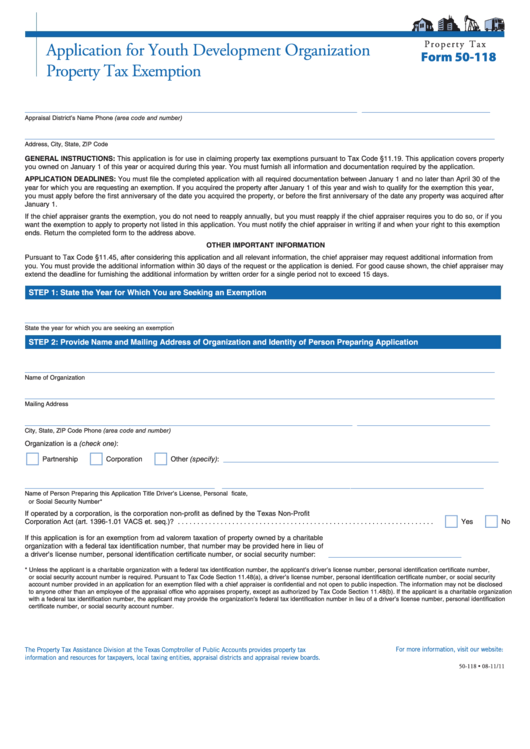

P r o p e r t y T a x

Application for Youth Development Organization

Form 50-118

Property Tax Exemption

______________________________________________________________________

___________________________

Appraisal District’s Name

Phone (area code and number)

___________________________________________________________________________________________________

Address, City, State, ZIP Code

GENERAL INSTRUCTIONS: This application is for use in claiming property tax exemptions pursuant to Tax Code §11.19. This application covers property

you owned on January 1 of this year or acquired during this year. You must furnish all information and documentation required by the application.

APPLICATION DEADLINES: You must file the completed application with all required documentation between January 1 and no later than April 30 of the

year for which you are requesting an exemption. If you acquired the property after January 1 of this year and wish to qualify for the exemption this year,

you must apply before the first anniversary of the date you acquired the property, or before the first anniversary of the date any property was acquired after

January 1.

If the chief appraiser grants the exemption, you do not need to reapply annually, but you must reapply if the chief appraiser requires you to do so, or if you

want the exemption to apply to property not listed in this application. You must notify the chief appraiser in writing if and when your right to this exemption

ends. Return the completed form to the address above.

OTHER IMPORTANT INFORMATION

Pursuant to Tax Code §11.45, after considering this application and all relevant information, the chief appraiser may request additional information from

you. You must provide the additional information within 30 days of the request or the application is denied. For good cause shown, the chief appraiser may

extend the deadline for furnishing the additional information by written order for a single period not to exceed 15 days.

STEP 1: State the Year for Which You are Seeking an Exemption

_______________________________

State the year for which you are seeking an exemption

STEP 2: Provide Name and Mailing Address of Organization and Identity of Person Preparing Application

___________________________________________________________________________________________________

Name of Organization

___________________________________________________________________________________________________

Mailing Address

_____________________________________________________________________

____________________________

City, State, ZIP Code

Phone (area code and number)

Organization is a (check one):

__________________________________________________________

Partnership

Corporation

Other (specify):

________________________________________

___________________________

____________________________

Name of Person Preparing this Application

Title

Driver’s License, Personal I.D. Certificate,

or Social Security Number*

If operated by a corporation, is the corporation non-profit as defined by the Texas Non-Profit

Corporation Act (art. 1396-1.01 VACS et. seq.)? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

If this application is for an exemption from ad valorem taxation of property owned by a charitable

organization with a federal tax identification number, that number may be provided here in lieu of

____________________________

a driver’s license number, personal identification certificate number, or social security number: . . . . . . . . . . .

* Unless the applicant is a charitable organization with a federal tax identification number, the applicant’s driver’s license number, personal identification certificate number,

or social security account number is required. Pursuant to Tax Code Section 11.48(a), a driver’s license number, personal identification certificate number, or social security

account number provided in an application for an exemption filed with a chief appraiser is confidential and not open to public inspection. The information may not be disclosed

to anyone other than an employee of the appraisal office who appraises property, except as authorized by Tax Code Section 11.48(b). If the applicant is a charitable organization

with a federal tax identification number, the applicant may provide the organization’s federal tax identification number in lieu of a driver’s license number, personal identification

certificate number, or social security account number.

The Property Tax Assistance Division at the Texas Comptroller of Public Accounts provides property tax

For more information, visit our website:

information and resources for taxpayers, local taxing entities, appraisal districts and appraisal review boards.

50-118 • 08-11/11

1

1 2

2 3

3 4

4