Form Char410-R - Re-Registration Statement For Charitable Organizations - 2010

ADVERTISEMENT

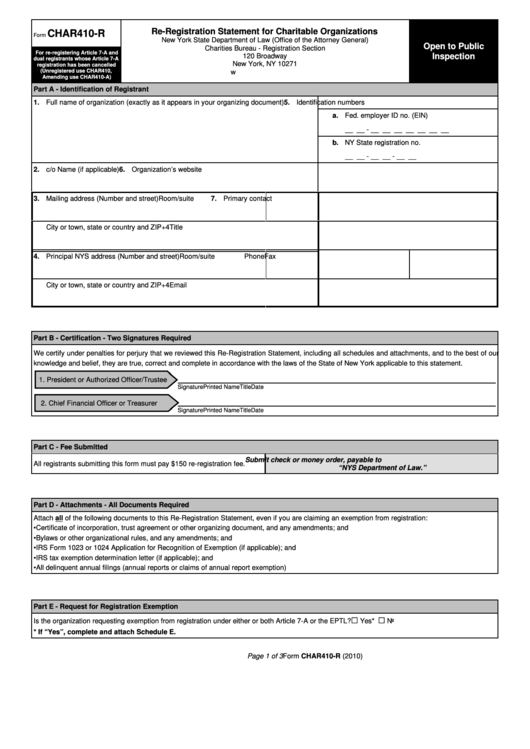

Re-Registration Statement for Charitable Organizations

CHAR410-R

Form

New York State Department of Law (Office of the Attorney General)

Open to Public

Charities Bureau - Registration Section

For re-registering Article 7-A and

120 Broadway

Inspection

dual registrants whose Article 7-A

New York, NY 10271

registration has been cancelled

(Unregistered use CHAR410,

Amending use CHAR410-A)

Part A - Identification of Registrant

1. Full name of organization (exactly as it appears in your organizing document)

5. Identification numbers

a. Fed. employer ID no. (EIN)

__ __ - __ __ __ __ __ __ __

b. NY State registration no.

__ __ - __ __ - __ __

2. c/o Name (if applicable)

6. Organization’s website

Room/suite

3. Mailing address (Number and street)

7. Primary contact

City or town, state or country and ZIP+4

Title

4. Principal NYS address (Number and street)

Room/suite

Phone

Fax

City or town, state or country and ZIP+4

Email

Part B - Certification - Two Signatures Required

We certify under penalties for perjury that we reviewed this Re-Registration Statement, including all schedules and attachments, and to the best of our

knowledge and belief, they are true, correct and complete in accordance with the laws of the State of New York applicable to this statement.

1. President or Authorized Officer/Trustee

Signature

Printed Name

Title

Date

2. Chief Financial Officer or Treasurer

Signature

Printed Name

Title

Date

Part C - Fee Submitted

Submit check or money order, payable to

All registrants submitting this form must pay $150 re-registration fee.

“NYS Department of Law.”

Part D - Attachments - All Documents Required

Attach all of the following documents to this Re-Registration Statement, even if you are claiming an exemption from registration:

•

Certificate of incorporation, trust agreement or other organizing document, and any amendments; and

•

Bylaws or other organizational rules, and any amendments; and

•

IRS Form 1023 or 1024 Application for Recognition of Exemption (if applicable); and

•

IRS tax exemption determination letter (if applicable); and

•

All delinquent annual filings (annual reports or claims of annual report exemption)

Part E - Request for Registration Exemption

G

G

Is the organization requesting exemption from registration under either or both Article 7-A or the EPTL? . . . . . . . . . . . . . . . . . . . . . . . . .

Yes*

No

* If “Yes”, complete and attach Schedule E.

Page 1 of 3

Form CHAR410-R (2010)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3