Form Char410-A - Amended Registration Statement For Charitable Organizations - 2010

ADVERTISEMENT

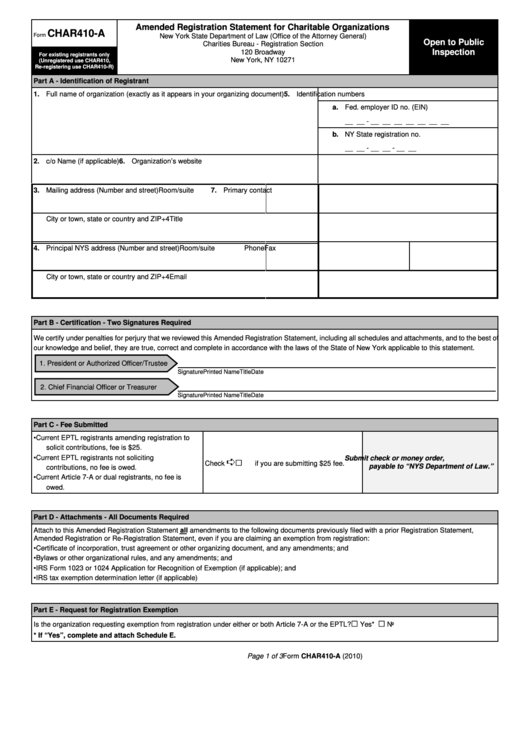

Amended Registration Statement for Charitable Organizations

CHAR410-A

Form

New York State Department of Law (Office of the Attorney General)

Open to Public

Charities Bureau - Registration Section

Inspection

120 Broadway

For existing registrants only

New York, NY 10271

(Unregistered use CHAR410,

Re-registering use CHAR410-R)

Part A - Identification of Registrant

1. Full name of organization (exactly as it appears in your organizing document)

5. Identification numbers

a. Fed. employer ID no. (EIN)

__ __ - __ __ __ __ __ __ __

b. NY State registration no.

__ __ - __ __ - __ __

2. c/o Name (if applicable)

6. Organization’s website

3. Mailing address (Number and street)

Room/suite

7. Primary contact

City or town, state or country and ZIP+4

Title

4. Principal NYS address (Number and street)

Room/suite

Phone

Fax

City or town, state or country and ZIP+4

Email

Part B - Certification - Two Signatures Required

We certify under penalties for perjury that we reviewed this Amended Registration Statement, including all schedules and attachments, and to the best of

our knowledge and belief, they are true, correct and complete in accordance with the laws of the State of New York applicable to this statement.

1. President or Authorized Officer/Trustee

Signature

Printed Name

Title

Date

2. Chief Financial Officer or Treasurer

Signature

Printed Name

Title

Date

Part C - Fee Submitted

•

Current EPTL registrants amending registration to

solicit contributions, fee is $25.

•

Current EPTL registrants not soliciting

Submit check or money order,

-

G

Check

if you are submitting $25 fee.

payable to “NYS Department of Law.”

contributions, no fee is owed.

•

Current Article 7-A or dual registrants, no fee is

owed.

Part D - Attachments - All Documents Required

Attach to this Amended Registration Statement all amendments to the following documents previously filed with a prior Registration Statement,

Amended Registration or Re-Registration Statement, even if you are claiming an exemption from registration:

•

Certificate of incorporation, trust agreement or other organizing document, and any amendments; and

•

Bylaws or other organizational rules, and any amendments; and

•

IRS Form 1023 or 1024 Application for Recognition of Exemption (if applicable); and

•

IRS tax exemption determination letter (if applicable)

Part E - Request for Registration Exemption

G

G

Is the organization requesting exemption from registration under either or both Article 7-A or the EPTL? . . . . . . . . . . . . . . . . . . . . . . . . .

Yes*

No

* If “Yes”, complete and attach Schedule E.

Page 1 of 3

Form CHAR410-A (2010)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3