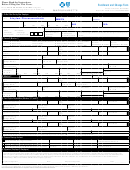

3. Beneficiary Designation

It is important to name a beneficiary. If you don't, your assets may be distributed based on rules that do not reflect your intentions. Additionally,

your designation usually supersedes any other instructions, such as those in your will.

If you prefer, you can designate your beneficiaries online at The online process is faster, easy and secure. If you use

this form, this designation will apply to the plan(s) listed above. If you want to designate different beneficiaries by plan(s), please complete another

form and circle the applicable plan(s) on each form.

Complete Sections 1, 2, 3 and 4. Only if applicable, complete Section 5. Mail to: Vanguard, P.O. Box 1101, Valley Forge, PA 19482.

3a. Current Marital Status

Check one.

Married

I understand that if I do not name my spouse as my sole primary beneficiary in Section 3, my spouse must consent to my chosen

beneficiary(ies) in the presence of a notary public and complete Section 5.

Unmarried

I understand that if I marry in the future, my spouse will be my primary beneficiary, unless I complete a new Beneficiary Designation and

my spouse consents to a different beneficiary in the presence of a notary public.

The percentage of distribution upon your death for all primary beneficiaries must equal 100%; likewise, for contingent beneficiaries. If you need

more space to list additional beneficiaries, photocopy the applicable pages or provide all the information requested on a separate sheet.

If any of your primary beneficiaries is deceased at the time of your death, his or her portion of your assets will be divided proportionately among

your surviving primary beneficiaries, if any. Your contingent beneficiary(ies) will inherit your assets only if you have no surviving primary

beneficiaries at the time of your death.

Primary Beneficiaries

Beneficiary Type

Trust(s)

My Estate

Spouse

Individual(s)

Choose all that apply.

To the trustee of an existing trust

created under agreement

To the trustee of a trust

created under my last will

Section of Will

Complete all applicable fields below.

1)

%

MM/DD/YYYY

Full Name (First, Middle, Last) or Trust Name

Relationship to me

Birth or Trust Date

Percent

Street or P.O. Box

OR

Last Four Digits of SSN

City, State, Zip

Country (if not U.S.)

2)

%

MM/DD/YYYY

Relationship to me

Full Name (First, Middle, Last) or Trust Name

Birth or Trust Date

Percent

Street or P.O. Box

OR

Last Four Digits of SSN

Country (if not U.S.)

City, State, Zip

3)

%

MM/DD/YYYY

Relationship to me

Full Name (First, Middle, Last) or Trust Name

Birth or Trust Date

Percent

Street or P.O. Box

OR

Last Four Digits of SSN

Country (if not U.S.)

Total

City, State, Zip

Percentages

<

must total

100%

100%.

2 of 4

1

1 2

2 3

3 4

4