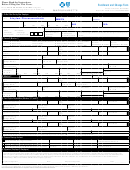

5. Acceptance and Authorization

Please sign the application below and return the form and Salary Reduction

Agreement to JHU's Benefit's Service Center for review.

(A) Employee Acceptance:

I hereby agree to the terms and conditions of the Vanguard 403(b)(7) Custodial Account Agreement.

Signature:

Date:

(B) Custodian Acceptance:

Vanguard Fiduciary Trust Company hereby accepts its appointment as Custodian under the Vanguard Section

403(b)(7) Custodial Account Agreement for the benefit of the Employee named above, and hereby agrees to the terms and conditions of such

Agreement.

Secretary

Authorized Signature:

Title:

Explanation of Terms of the Qualified Pre-Retirement Survivor Annuity (QPSA)

Qualified Pre-Retirement Survivor Annuity (QPSA) Notice to Married Participants

As required by federal law and the terms of the Plan named on this form, the Plan will distribute a qualified pre-retirement survivor annuity ("QPSA") to

your surviving spouse if you die before your benefit payments commence under the Plan, unless you waive this form of payment and your spouse

consents to that waiver. The plan trustee will distribute the QPSA by using your non-forfeitable account balance to purchase an annuity contract from an

insurance company for your surviving spouse, and your spouse may elect to receive distribution of the QPSA benefit following your death. Under the

QPSA, your surviving spouse will receive a lifetime level monthly payment.

The actual level monthly payments made under the QPSA will depend on the annuity purchase rate used by the insurance company, your surviving

spouse's age at the time the distribution begins, and the amount of your vested account balance at the time that the annuity contract is purchased. Your

surviving spouse may elect to receive the portion of your vested account balance payable as a QPSA as a lump-sum distribution or in installment

payments, in lieu of the QPSA. If, at the time of your death, your non-forfeitable account balance is not greater than $5,000, the plan trustee will make a

lump-sum distribution to your surviving spouse in lieu of providing the QPSA benefit.

You may waive the QPSA benefit at any time during the QPSA election period. This is the period beginning on the first day of the Plan Year that you

reach age 35 and ending on the date of your death. If you waive the QPSA benefit prior to attaining age 35, you will need to make another waiver after

your 35th birthday. Please note that the waiver election is valid only for the spouse consenting to the waiver, so you would need to complete a new

waiver if you should remarry.

In order to waive the QPSA benefit or designate a beneficiary other than your spouse, you must complete the waiver election on this form, and your

spouse must consent to the waiver by signing the spousal consent. A notary public must witness your spouse's signature. Your decision to accept or

waive the QPSA will not affect your retirement benefit under the Plan. There is no reduction or increase in your retirement benefit as a result of your

election to waive or not waive the QPSA benefit.

The following notice below to your spouse explains the effect of the QPSA benefit.

Qualified Pre-Retirement Survivor Annuity (QPSA) Notice to Spouse

What is a QPSA?

Your spouse has an account in the Plan. The money in the account that your spouse will be entitled to receive is called the vested

account. Federal law states that you, as spouse of the participant in the Plan, will receive a special death benefit that is paid from the vested account if

your spouse dies before he or she begins receiving retirement benefits (or, if earlier, before the beginning of the period for which the retirement benefits

are paid). You have the right to receive this death benefit in the form of an annuity payable for your life beginning after your spouse dies. The special

death benefit is often called a "qualified pre-retirement survivor annuity" or QPSA benefit. If the value of this benefit is $5,000 or less, the Plan may pay

this benefit to you in a lump-sum, rather than a QPSA.

Can Your Spouse Choose Other Beneficiaries to Receive the Account?

Your right to the QPSA benefit is provided by federal law and cannot be

taken away unless you agree to give up that benefit. If you agree, your spouse can choose to have all or part of the death benefits paid to someone else.

The person your spouse chooses to receive the death benefits is usually called the "beneficiary". For example, if you agree, your spouse can have the

death benefits paid to his or her children instead of you.

Do You Have to Give Up Your Right to the QPSA Benefit? Your choice must be voluntary.

It is your personal decision whether you want to give

up your right to the special QPSA payment form.

Can Your Spouse Change the Beneficiary in the Future If You Sign this Form?

If you sign this form, your spouse cannot change the

beneficiary named in this form unless you agree to the new beneficiary by signing a new form. If you agree, your spouse can change the beneficiary at

any time before your spouse begins receiving benefits or dies. You do not have to agree to let your spouse change the beneficiary. However, your

spouse can select the QPSA benefit for you without getting your agreement.

Can You Change Your Mind After You Sign this Form?

You cannot change this agreement after you sign this form. Your decision is final.

What Happens to this QPSA Beneficiary Designation Form If You Become Separated or Divorced?

You may lose your right to the QPSA

benefit if your spouse and you become legally separated or divorced even if you do not sign this QPSA Beneficiary Designation Form. However, if you

become legally separated or divorced, you might be able to get a special court order (which is called a qualified domestic relations order or "QDRO") that

specifically protects your rights to receive the QPSA benefit or that give you other benefits under the Plan. If you are thinking about separating or getting

a divorce, you should get legal advice on your rights to benefits from the Plan.

4 of 4

1

1 2

2 3

3 4

4