Louisiana Public Employees Deferred Compensation Plan Template - Salary Deferral Agreement Irc Section 457

ADVERTISEMENT

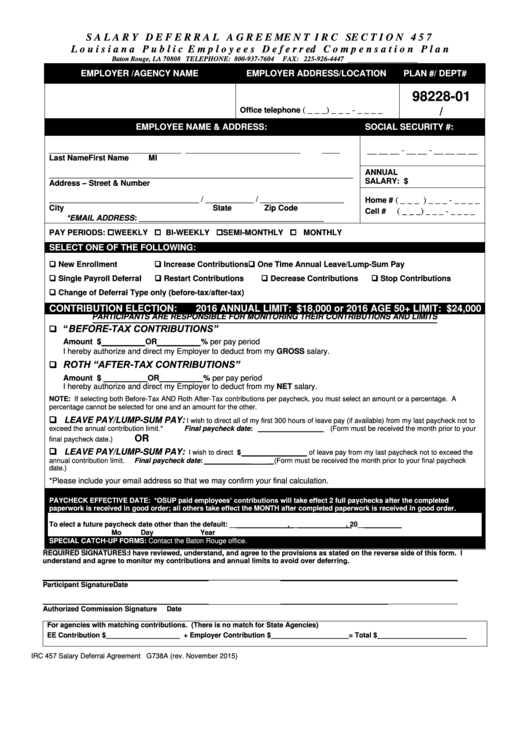

S A L A R Y D E F E R R A L A G R E E M E N T I R C S E C T I O N 4 5 7

L o u i s i a n a P u b l i c E m p l o y e e s D e f e r r e d C o m p e n s a t i o n P l a n

FAX: 225-926-4447

Baton Rouge, LA 70808 TELEPHONE: 800-937-7604

EMPLOYER /AGENCY NAME

EMPLOYER ADDRESS/LOCATION

PLAN #/ DEPT#

98228-01

_ _ _

_ _ _

_ _ _ _

(

)

-

/

Office telephone

EMPLOYEE NAME & ADDRESS:

SOCIAL SECURITY #:

______________________________ __________________________

____

__ __ __ - __ __ - __ __ __ __

Last Name

First Name

MI

ANNUAL

_____________________________________________________________________

SALARY: $

Address – Street & Number

__________________________________ / ___________ / ___________________

_ _ _

_ _ _

_ _ _ _

(

)

-

Home #

City

State

Zip Code

_ _ _

Cell #

(

) _ _ _ - _ _ _ _

________________________________________

*EMAIL ADDRESS:

PAY PERIODS: WEEKLY BI-WEEKLY SEMI-MONTHLY MONTHLY

SELECT ONE OF THE FOLLOWING:

New Enrollment

Increase Contributions

One Time Annual Leave/Lump-Sum Pay

Single Payroll Deferral

Restart Contributions

Decrease Contributions

Stop Contributions

Change of Deferral Type only (before-tax/after-tax)

CONTRIBUTION ELECTION:

2016 ANNUAL LIMIT: $18,000 or 2016 AGE 50+ LIMIT: $24,000

PARTICIPANTS ARE RESPONSIBLE FOR MONITORING THEIR CONTRIBUTIONS AND LIMITS

“BEFORE-TAX CONTRIBUTIONS”

Amount $__________OR__________% per pay period

I hereby authorize and direct my Employer to deduct from my GROSS salary.

ROTH “AFTER-TAX CONTRIBUTIONS”

Amount $ __________OR__________% per pay period

I hereby authorize and direct my Employer to deduct from my NET salary.

NOTE: If selecting both Before-Tax AND Roth After-Tax contributions per paycheck, you must select an amount or a percentage. A

percentage cannot be selected for one and an amount for the other.

LEAVE PAY/LUMP-SUM PAY:

I wish to direct all of my first 300 hours of leave pay (if available) from my last paycheck not to

exceed the annual contribution limit.*

Final paycheck date: _________________ (Form must be received the month prior to your

OR

final paycheck date.)

LEAVE PAY/LUMP-SUM PAY:

I wish to direct $_________________ of leave pay from my last paycheck not to exceed the

annual contribution limit.

Final paycheck date: __________________ (Form must be received the month prior to your final paycheck

date.)

*Please include your email address so that we may confirm your final calculation.

PAYCHECK EFFECTIVE DATE: *OSUP paid employees’ contributions will take effect 2 full paychecks after the completed

paperwork is received in good order; all others take effect the MONTH after completed paperwork is received in good order.

To elect a future paycheck date other than the default:

_______________, ______________, 20__________

Mo

Day

Year

SPECIAL CATCH-UP FORMS: Contact the Baton Rouge office.

REQUIRED SIGNATURES: I have reviewed, understand, and agree to the provisions as stated on the reverse side of this form. I

understand and agree to monitor my contributions and annual limits to avoid over deferring.

___________________________________________

______________________________________________

Participant Signature

Date

___________________________________________

______________________________________________

Authorized Commission Signature

Date

For agencies with matching contributions. (There is no match for State Agencies)

EE Contribution $___________________ + Employer Contribution $____________________= Total $_______________________

IRC 457 Salary Deferral Agreement G738A (rev. November 2015)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2