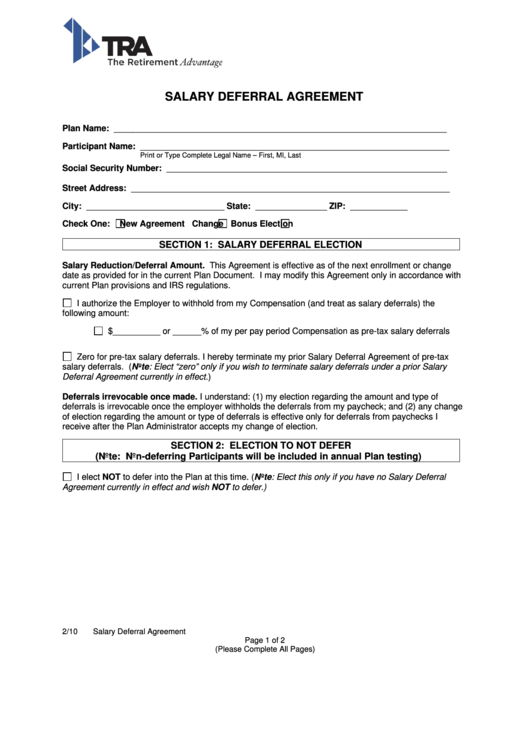

SALARY DEFERRAL AGREEMENT

Plan Name: ______________________________________________________________________

Participant Name: _________________________________________________________________

Print or Type Complete Legal Name – First, MI, Last

Social Security Number: ___________________________________________________________

Street Address: ___________________________________________________________________

City: _____________________________

State: _______________

ZIP: ____________

Check One:

New Agreement

Change

Bonus Election

SECTION 1: SALARY DEFERRAL ELECTION

Salary Reduction/Deferral Amount. This Agreement is effective as of the next enrollment or change

date as provided for in the current Plan Document. I may modify this Agreement only in accordance with

current Plan provisions and IRS regulations.

I authorize the Employer to withhold from my Compensation (and treat as salary deferrals) the

following amount:

$__________ or ______% of my per pay period Compensation as pre-tax salary deferrals

Zero for pre-tax salary deferrals. I hereby terminate my prior Salary Deferral Agreement of pre-tax

salary deferrals. (Note: Elect “zero” only if you wish to terminate salary deferrals under a prior Salary

Deferral Agreement currently in effect.)

Deferrals irrevocable once made. I understand: (1) my election regarding the amount and type of

deferrals is irrevocable once the employer withholds the deferrals from my paycheck; and (2) any change

of election regarding the amount or type of deferrals is effective only for deferrals from paychecks I

receive after the Plan Administrator accepts my change of election.

SECTION 2: ELECTION TO NOT DEFER

(Note: Non-deferring Participants will be included in annual Plan testing)

I elect NOT to defer into the Plan at this time. (Note: Elect this only if you have no Salary Deferral

Agreement currently in effect and wish NOT to defer.)

2/10

Salary Deferral Agreement

Page 1 of 2

(Please Complete All Pages)

1

1 2

2