Print Form

Clear Form

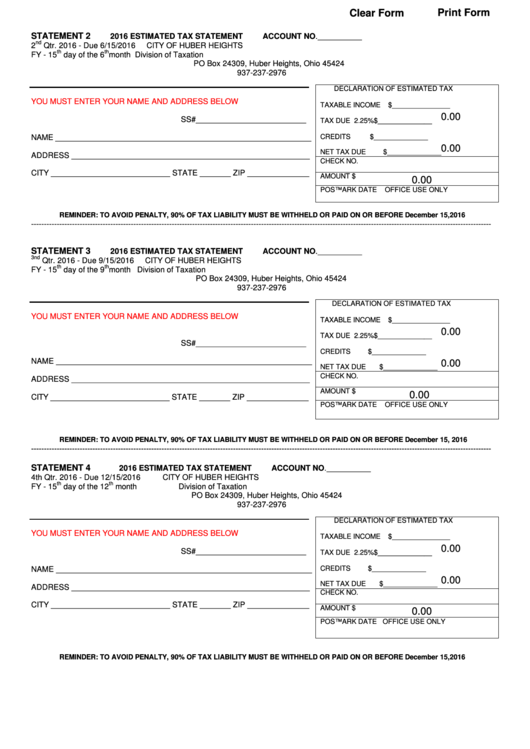

STATEMENT 2

2016 ESTIMATED TAX STATEMENT

ACCOUNT NO.__________

nd

2

Qtr. 2016 - Due 6/15/2016

CITY OF HUBER HEIGHTS

th

th

FY - 15

day of the 6

month

Division of Taxation

PO Box 24309, Huber Heights, Ohio 45424

937-237-2976

DECLARATION OF ESTIMATED TAX

YOU MUST ENTER YOUR NAME AND ADDRESS BELOW

TAXABLE INCOME

$_______________

0.00

SS#_________________________

TAX DUE 2.25%

$______________

CREDITS

$______________

NAME __________________________________________________________

0.00

NET TAX DUE

$______________

ADDRESS ______________________________________________________

CHECK NO.

CITY ___________________________ STATE _______ ZIP ______________

AMOUNT $

0.00

POSTMARK DATE

OFFICE USE ONLY

REMINDER: TO AVOID PENALTY, 90% OF TAX LIABILITY MUST BE WITHHELD OR PAID ON OR BEFORE December 15, 2016

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

STATEMENT 3

2016 ESTIMATED TAX STATEMENT

ACCOUNT NO.__________

3nd

Qtr. 2016 - Due 9/15/2016

CITY OF HUBER HEIGHTS

th

th

FY - 15

day of the 9

month

Division of Taxation

PO Box 24309, Huber Heights, Ohio 45424

937-237-2976

DECLARATION OF ESTIMATED TAX

YOU MUST ENTER YOUR NAME AND ADDRESS BELOW

TAXABLE INCOME

$_______________

0.00

TAX DUE 2.25%

$______________

SS#_________________________

CREDITS

$______________

NAME __________________________________________________________

0.00

NET TAX DUE

$______________

CHECK NO.

ADDRESS ______________________________________________________

AMOUNT $

0.00

CITY ___________________________ STATE _______ ZIP ______________

POSTMARK DATE

OFFICE USE ONLY

REMINDER: TO AVOID PENALTY, 90% OF TAX LIABILITY MUST BE WITHHELD OR PAID ON OR BEFORE December 15, 2016

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

STATEMENT 4

2016 ESTIMATED TAX STATEMENT

ACCOUNT NO.__________

4th Qtr. 2016 - Due 12/15/2016

CITY OF HUBER HEIGHTS

th

th

FY - 15

day of the 12

month

Division of Taxation

PO Box 24309, Huber Heights, Ohio 45424

937-237-2976

DECLARATION OF ESTIMATED TAX

YOU MUST ENTER YOUR NAME AND ADDRESS BELOW

TAXABLE INCOME

$_______________

0.00

SS#_________________________

TAX DUE 2.25%

$______________

NAME __________________________________________________________

CREDITS

$______________

0.00

NET TAX DUE

$______________

ADDRESS ______________________________________________________

CHECK NO.

CITY ___________________________ STATE _______ ZIP ______________

AMOUNT $

0.00

POSTMARK DATE

OFFICE USE ONLY

REMINDER: TO AVOID PENALTY, 90% OF TAX LIABILITY MUST BE WITHHELD OR PAID ON OR BEFORE December 15, 2016

1

1