Clear Form

Print Form

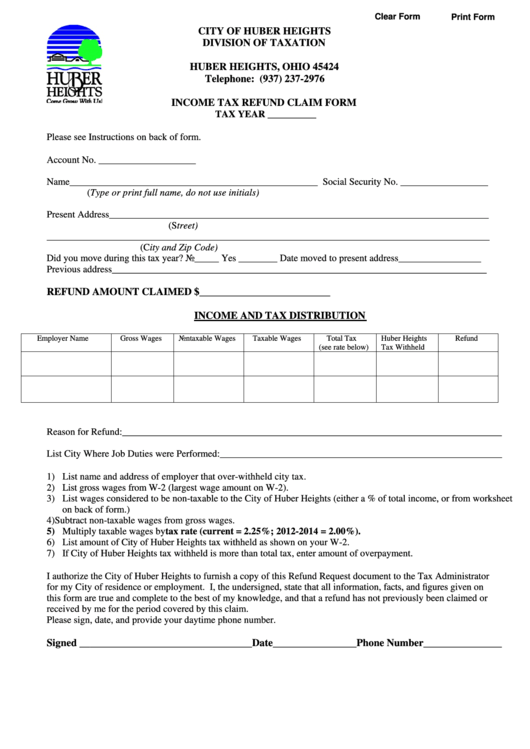

CITY OF HUBER HEIGHTS

DIVISION OF TAXATION

P.O. BOX 24309

HUBER HEIGHTS, OHIO 45424

Telephone: (937) 237-2976

INCOME TAX REFUND CLAIM FORM

TAX YEAR __________

Please see Instructions on back of form.

Account No. ____________________

Name___________________________________________________ Social Security No. __________________

(Type or print full name, do not use initials)

Present Address______________________________________________________________________________

(Street)

___________________________________________________________________________________________

(City and Zip Code)

Did you move during this tax year? No_____ Yes ________ Date moved to present address_________________

Previous address_____________________________________________________________________________

REFUND AMOUNT CLAIMED $_________________________

INCOME AND TAX DISTRIBUTION

Employer Name

Gross Wages

Nontaxable Wages

Taxable Wages

Total Tax

Huber Heights

Refund

(see rate below)

Tax Withheld

Reason for Refund:______________________________________________________________________________

List City Where Job Duties were Performed:__________________________________________________________

1) List name and address of employer that over-withheld city tax.

2) List gross wages from W-2 (largest wage amount on W-2).

3) List wages considered to be non-taxable to the City of Huber Heights (either a % of total income, or from worksheet

on back of form.)

4) Subtract non-taxable wages from gross wages.

5) Multiply taxable wages by tax rate (current = 2.25%; 2012-2014 = 2.00%).

6) List amount of City of Huber Heights tax withheld as shown on your W-2.

7) If City of Huber Heights tax withheld is more than total tax, enter amount of overpayment.

I authorize the City of Huber Heights to furnish a copy of this Refund Request document to the Tax Administrator

for my City of residence or employment. I, the undersigned, state that all information, facts, and figures given on

this form are true and complete to the best of my knowledge, and that a refund has not previously been claimed or

received by me for the period covered by this claim.

Please sign, date, and provide your daytime phone number.

Signed _________________________________Date________________Phone Number_______________

1

1 2

2