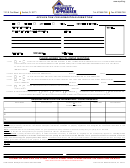

Applying for the owner occupied homestead classification

How to apply

Required information

Penalties

To apply for the homestead

Minnesota Statutes, section 273.124,

Making false statements on this

classification for your residence, you

subdivision 13 requires Social

application is against the law.

must fill out this application. To

Security numbers and signatures of

Minnesota Statutes, section 609.41

qualify for the homestead

all owners occupying the property

states that anyone giving false

classification, you must: (All three

and each owner’s spouse that

information in order to avoid or

must apply.)

occupies the property to be listed on

reduce their tax obligations is subject

this application.

to a fine of up to $3,000 and/or up to

Be one of the owners of the

1.

one year in prison.

property listed on this

Additionally, each owner’s spouse

application.

who occupies the property also must

In addition, the property owner may

Occupy the property listed on

2.

be listed on the homestead

be required to pay all tax which is

this application as your primary

application even if the owner’s

due on the property based on its

residence.

spouse is not listed as an owner on

correct property class, plus a penalty

Be a Minnesota resident.

3.

the deed of record.

equal to the same amount.

(Minnesota Statutes, section 273.124,

Your county assessor will determine

If there is not enough space on the

subdivision 13, paragraph h)

if you are a Minnesota resident for

application for all required signatures

homestead purposes. Some of the

and Social Security numbers, please

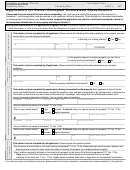

Renewing your homestead

conditions that may be used to

use an extra sheet and include it with

classification

determine your residency status

the application.

If this property is granted the

include:

homestead classification, it is not

ƒ

Are you registered to vote in

How we use information

necessary for you to reapply for the

Minnesota?

The Social Security numbers or

classification.

ƒ

Do you have a valid Minnesota

affidavits or other proofs of property

driver's license?

owners and spouses are private data.

However, at any time, the county

ƒ

Do you file a Minnesota income

Minnesota Statutes, section 273.124,

assessor may require you to provide

tax return?

subdivision 13, authorizes the

an additional application or other

ƒ

collection of Social Security numbers

proof deemed necessary to verify that

Do you list property in

and signatures of all applicants,

you continue to qualify for the

Minnesota as your permanent

including spouses, on homestead

homestead classification.

mailing address?

ƒ

applications.

Do your children, if any, attend

If you sell, move or change

school in Minnesota?

ƒ

The county assessor may share the

your marital status

Are you a resident of any other

information contained on this form

If this property is sold, you or your

state or country?

with the county auditor, county

spouse changes your primary

treasurer, county attorney,

residence, or you change your marital

Application deadline

Commissioner of Revenue, or other

status, state law requires you to notify

The homestead application must be

federal, state or local taxing

the county assessor within 30 days.

turned into the county assessor’s

authorities to verify your compliance

office by December 15 to be eligible

with this and other tax programs.

If you fail to notify the county

for the homestead classification for

assessor within 30 days of the

taxes payable in the following year.

You can refuse to provide the

change, the property may be assessed

information on this form. However,

the tax that is due on the property

failure to provide this information

based on its correct property class

may result in a fractional homestead

plus a penalty equal to the same

or denial of the homestead

amount.

classification.

Please return this application to:

Stearns County Assessor

Administration Center, Rm 37

705 Courthouse Sq

St Cloud, MN 56303

Revised11/05

1

1 2

2