Original Application For Ad Valorem Tax Exemption Form - Lake County, Fl

ADVERTISEMENT

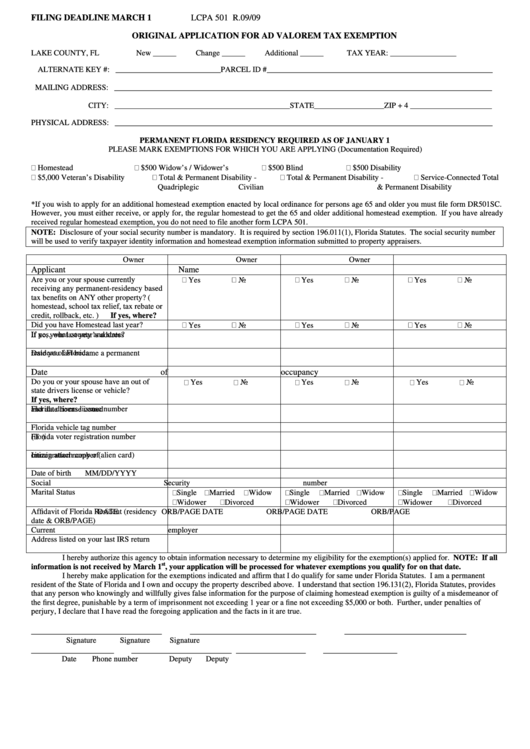

FILING DEADLINE MARCH 1

LCPA 501 R.09/09

ORIGINAL APPLICATION FOR AD VALOREM TAX EXEMPTION

LAKE COUNTY, FL

New ______

Change ______

Additional ______

TAX YEAR: _________________

ALTERNATE KEY #: ___________________________PARCEL ID #__________________________________________________________

MAILING ADDRESS: _________________________________________________________________________________________________

CITY: _____________________________________________STATE__________________ZIP + 4 _____________________

PHYSICAL ADDRESS: _________________________________________________________________________________________________

PERMANENT FLORIDA RESIDENCY REQUIRED AS OF JANUARY 1

PLEASE MARK EXEMPTIONS FOR WHICH YOU ARE APPLYING (Documentation Required)

Homestead

$500 Widow’s / Widower’s

$500 Blind

$500 Disability

$5,000 Veteran’s Disability

Total & Permanent Disability -

Total & Permanent Disability -

Service-Connected Total

ty

Quadriplegic

Civilian

& Permanent Disabili

*If you wish to apply for an additional homestead exemption enacted by local ordinance for persons age 65 and older you must file form DR501SC.

However, you must either receive, or apply for, the regular homestead to get the 65 and older additional homestead exemption. If you have already

received regular homestead exemption, you do not need to file another form LCPA 501.

NOTE: Disclosure of your social security number is mandatory. It is required by section 196.011(1), Florida Statutes. The social security number

will be used to verify taxpayer identity information and homestead exemption information submitted to property appraisers.

Owner

Owner

Owner

Applicant Name

Are you or your spouse currently

Yes

No

Yes

No

Yes

No

receiving any permanent-residency based

tax benefits on ANY other property? (i.e.

homestead, school tax relief, tax rebate or

credit, rollback, etc. )

If yes, where?

Did you have Homestead last year?

Yes

No

Yes

No

Yes

No

If yes, what county and state?

If no, your last year’s address

Date you last became a permanent

resident of Florida

Date of occupancy

Do you or your spouse have an out of

Yes

No

Yes

No

Yes

No

state drivers license or vehicle?

If yes, where?

Florida drivers license number

and date license issued

Florida vehicle tag number

Florida voter registration number

(if U.S. citizen)

Immigration number (non-U.S.

citizen attach copy of alien card)

Date of birth

MM/DD/YYYY

Social Security number

Marital Status

Single

Married

Widow

Single

Married

Widow

Single

Married

Widow

Widower

Divorced

Widower

Divorced

Widower

Divorced

Affidavit of Florida Resident (residency

DATE

ORB/PAGE

DATE

ORB/PAGE

DATE

ORB/PAGE

date & ORB/PAGE)

Current employer

Address listed on your last IRS return

I hereby authorize this agency to obtain information necessary to determine my eligibility for the exemption(s) applied for. NOTE: If all

st

information is not received by March 1

, your application will be processed for whatever exemptions you qualify for on that date.

I hereby make application for the exemptions indicated and affirm that I do qualify for same under Florida Statutes. I am a permanent

resident of the State of Florida and I own and occupy the property described above. I understand that section 196.131(2), Florida Statutes, provides

that any person who knowingly and willfully gives false information for the purpose of claiming homestead exemption is guilty of a misdemeanor of

the first degree, punishable by a term of imprisonment not exceeding 1 year or a fine not exceeding $5,000 or both. Further, under penalties of

perjury, I declare that I have read the foregoing application and the facts in it are true.

______________________________

_____________________________

____________________________

Signature

Signature

Signature

___________________

_______________________

________________

_________________

Date

Phone number

Deputy

Deputy

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2