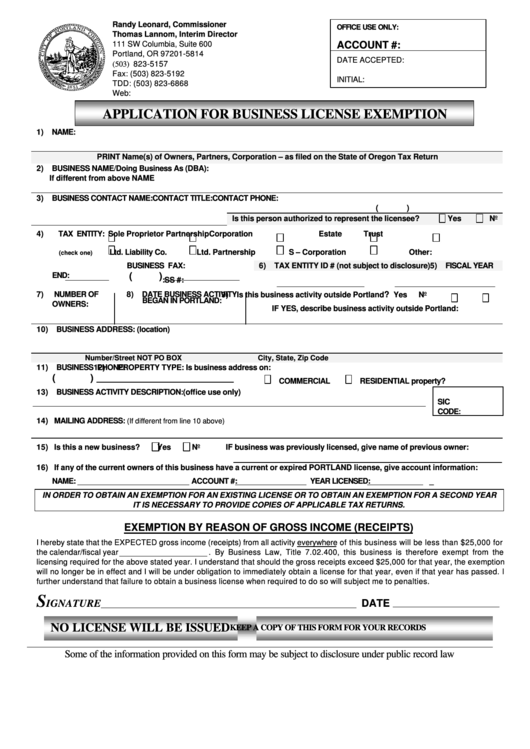

Application For Business License Exemption Form

ADVERTISEMENT

Randy Leonard, Commissioner

OFFICE USE ONLY:

Thomas Lannom, Interim Director

111 SW Columbia, Suite 600

ACCOUNT #:

Portland, OR 97201-5814

DATE ACCEPTED:

(503) 823-5157

Fax: (503) 823-5192

INITIAL:

TDD: (503) 823-6868

Web:

APPLICATION FOR BUSINESS LICENSE EXEMPTION

1)

NAME:

PRINT Name(s) of Owners, Partners, Corporation – as filed on the State of Oregon Tax Return

2)

BUSINESS NAME/Doing Business As (DBA):

If different from above NAME

3)

BUSINESS CONTACT NAME:

CONTACT TITLE:

CONTACT PHONE:

(

)

Is this person authorized to represent the licensee?

Yes

No

4)

TAX ENTITY:

Sole Proprietor

Partnership

Corporation

Estate

Trust

Ltd. Liability Co.

Ltd. Partnership

S – Corporation

Other:

(check one)

5)

FISCAL YEAR

BUSINESS FAX:

6)

TAX ENTITY ID # (not subject to disclosure)

END:

(

)

F.E.I.N:

SS #:

7)

NUMBER OF

8)

DATE BUSINESS ACTIVITY

?

9)

Is this business activity outside Portland

Yes

No

OWNERS:

BEGAN IN PORTLAND:

IF YES, describe business activity outside Portland:

10) BUSINESS ADDRESS: (location)

Number/Street NOT PO BOX

City, State, Zip Code

11) BUSINESS PHONE:

12)

PROPERTY TYPE: Is business address on:

(

)

COMMERCIAL

RESIDENTIAL property?

13) BUSINESS ACTIVITY DESCRIPTION:

(office use only)

SIC

CODE:

14) MAILING ADDRESS:

(If different from line 10 above)

15) Is this a new business?

Yes

No

IF business was previously licensed, give name of previous owner:

16) If any of the current owners of this business have a current or expired PORTLAND license, give account information:

NAME:

ACCOUNT #:

YEAR LICENSED:

_

IN ORDER TO OBTAIN AN EXEMPTION FOR AN EXISTING LICENSE OR TO OBTAIN AN EXEMPTION FOR A SECOND YEAR

IT IS NECESSARY TO PROVIDE COPIES OF APPLICABLE TAX RETURNS.

EXEMPTION BY REASON OF GROSS INCOME (RECEIPTS)

I hereby state that the EXPECTED gross income (receipts) from all activity everywhere of this business will be less than $25,000 for

the calendar/fiscal year

. By Business Law, Title 7.02.400, this business is therefore exempt from the

licensing required for the above stated year. I understand that should the gross receipts exceed $25,000 for that year, the exemption

will no longer be in effect and I will be under obligation to immediately obtain a license for that year, even if that year has passed. I

further understand that failure to obtain a business license when required to do so will subject me to penalties.

S

IGNATURE

DATE

NO LICENSE WILL BE ISSUED

KEEP A COPY OF THIS FORM FOR YOUR RECORDS

Some of the information provided on this form may be subject to disclosure under public record law

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1