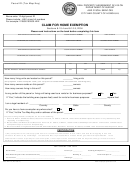

Boe-267 (S1b)(S2) - Claim For Welfare Exemption (First Filing) Page 2

ADVERTISEMENT

14.

Description of Property and Property Use: Assessor’s parcel number or legal description

(a)

If seeking exemption on Land, provide the following:

(a)(1)

Area in acres or square feet

(a)(2)

Primary and incidental use of the property described

(b) If seeking exemption on Buildings or Improvements, please provide the following:

(b)(1)

Building number or name, number of floors, number of rooms, type of construction

(b)(2)

State the primary and incidental use of the property described

(c) If seeking exemption on personal property, provide the following:

(c)(1)

Personal Property description (type)

(c)(2)

State the primary and incidental use of the property described

15.

Owner and operator (carefully check applicable boxes)

Claimant is:

owner and operator

owner only

operator only and claims exemption on all

land

buildings and improvements and/or

personal property listed above. If persons or organizations other than the claimant use this property, please provide on an attached list including the name

of user, frequency of use, and square footage used.

16.

Leased or rented (since January 1 of prior year)

(a) Is any portion of the property indicated in 14 above rented, leased, or being used or operated part time or full time by some other person or organization?

Yes

No If yes, describe that portion and its use and attach a copy of agreement; list amount received by claimant:

(b) Is any equipment or other property at this location being leased, rented, or consigned from someone else?

Yes

No If yes, list equipment and

other property at this location that is being leased, rented, or consigned to the claimant. Please list the name and address of lessor or consignor and the

quantity and description of the property and attach to the claim. Property so listed is not subject to the exemption and will be assessed by the Assessor

if owned by a taxable entity.

17. Living quarters (since January 1 of prior year)

Is any portion of this property used for living quarters (other than low income housing or housing for the elderly or handicapped) for any person?

Yes

No If yes, describe that portion:

S u b m i t d o c u m e n t a t i o n t h a t t h e h o u s i n g i s i n c i d e n t a l t o a n d re a s o n a b l y n e c e s s a r y f o r t h e e x e m p t p u r p o s e s o f t h e

organization. (If living quarters associated with a rehabilitation program, submit BOE-267-R.) See instructions.

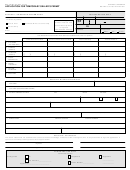

18.

Sale of personal property (since January 1 of prior year)

(a) Is any portion of the property indicated in 14 above used to operate a store, thrift shop, or other facility making sales to members or to the general

public?

Yes

No If yes, list hours per week the business is operated and describe nature of articles sold:

(b) Is this property used as a thrift shop as part of a planned formal rehabilitation program?

Yes

No If yes, submit BOE-267-R.

19.

Low-Income Housing

Is this property used as low income housing?

Yes

No If yes, form BOE-267-L must be submitted. If this property is owned by a limited partnership,

form BOE-267-L1 must also be submitted. Additionally, if this property is owned by a limited partnership, please submit a copy of the certified Secretary of

State form LP-1.

20.

Elderly or Handicapped Housing

Is this property used as a facility for the elderly or handicapped?

Yes

No If yes, form BOE-267-H must be submitted unless care or services are provided

or the property is financed by the federal government under sections 202, 231, 236, or 811 of the Federal Public Laws.

21.

Expansion

Do you contemplate any capital investment in the property within the next year?

Yes

No If yes, explain:

22. Financial statements relating exclusively to this property location

Attach to this claim a copy of your operating statement (income, expenses) and balance sheet (assets, liabilities)

for the calendar or fiscal year immediately preceding the claim year.

23. Is the property for which this exemption is sought used for activities that produce income that is “unrelated business taxable income,” as defined in section

512 of the Internal Revenue Code and that is subject to the tax imposed by section 511 of the Internal Revenue Code?

Yes

No

If yes, you must attach to this claim each of the following:

(1) The organization’s information and tax returns filed with the Internal Revenue Service for its immediately preceding fiscal year.

(2)

A statement setting forth the amount of time devoted to the organization’s income-producing and to its nonincome-producing activities and, where

applicable, a description of that portion of the property in which those activities are conducted.

(3) A statement listing the specific activities which produce the unrelated business taxable income.

(4)

A statement setting forth the amount of income of the organization that is attributable to activities in this state and is exempt from income or franchise

taxation and the amount of total income of the organization that is attributable to activities in this state.

BOE-267 (S1B)(S2) REV. 8 (08-05) EXM-417 (Rev. 08/05)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2