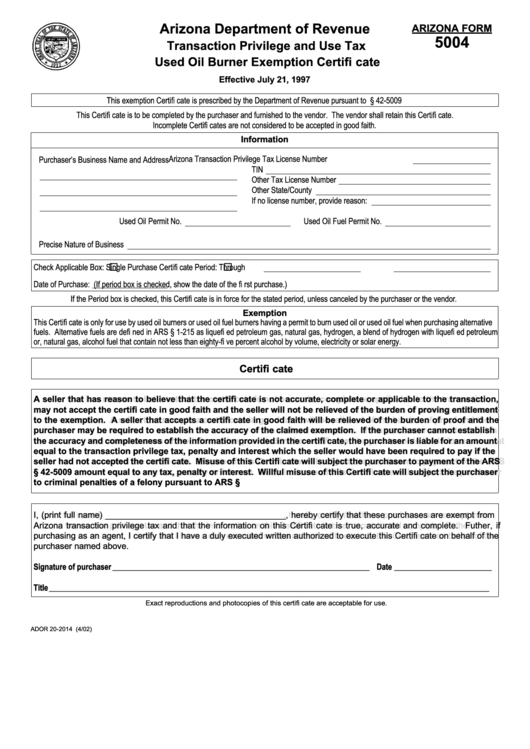

Arizona Department of Revenue

ARIZONA FORM

5004

Transaction Privilege and Use Tax

Used Oil Burner Exemption Certifi cate

Effective July 21, 1997

This exemption Certifi cate is prescribed by the Department of Revenue pursuant to A.R.S. § 42-5009

This Certifi cate is to be completed by the purchaser and furnished to the vendor. The vendor shall retain this Certifi cate.

Incomplete Certifi cates are not considered to be accepted in good faith.

Information

Information

Arizona Transaction Privilege Tax License Number

Purchaser’s Business Name and Address

TIN

Other Tax License Number

Other State/County

If no license number, provide reason:

Used Oil Permit No.

Used Oil Fuel Permit No.

Precise Nature of Business

Check Applicable Box:

Single Purchase Certifi cate

Period:

Through

Date of Purchase:

(If period box is checked, show the date of the fi rst purchase.)

If the Period box is checked, this Certifi cate is in force for the stated period, unless canceled by the purchaser or the vendor.

Exemption

Exemption

This Certifi cate is only for use by used oil burners or used oil fuel burners having a permit to burn used oil or used oil fuel when purchasing alternative

fuels. Alternative fuels are defi ned in ARS § 1-215 as liquefi ed petroleum gas, natural gas, hydrogen, a blend of hydrogen with liquefi ed petroleum

or, natural gas, alcohol fuel that contain not less than eighty-fi ve percent alcohol by volume, electricity or solar energy.

Certifi cate

Certifi cate

A seller that has reason to believe that the certifi cate is not accurate, complete or applicable to the transaction,

A seller that has reason to believe that the certifi cate is not accurate, complete or applicable to the transaction,

may not accept the certifi cate in good faith and the seller will not be relieved of the burden of proving entitlement

may not accept the certifi cate in good faith and the seller will not be relieved of the burden of proving entitlement

to the exemption. A seller that accepts a certifi cate in good faith will be relieved of the burden of proof and the

to the exemption. A seller that accepts a certifi cate in good faith will be relieved of the burden of proof and the

purchaser may be required to establish the accuracy of the claimed exemption. If the purchaser cannot establish

purchaser may be required to establish the accuracy of the claimed exemption. If the purchaser cannot establish

the accuracy and completeness of the information provided in the certifi cate, the purchaser is liable for an amount

the accuracy and completeness of the information provided in the certifi cate, the purchaser is liable for an amount

equal to the transaction privilege tax, penalty and interest which the seller would have been required to pay if the

equal to the transaction privilege tax, penalty and interest which the seller would have been required to pay if the

seller had not accepted the certifi cate. Misuse of this Certifi cate will subject the purchaser to payment of the ARS

seller had not accepted the certifi cate. Misuse of this Certifi cate will subject the purchaser to payment of the ARS

§ 42-5009 amount equal to any tax, penalty or interest. Willful misuse of this Certifi cate will subject the purchaser

§ 42-5009 amount equal to any tax, penalty or interest. Willful misuse of this Certifi cate will subject the purchaser

to criminal penalties of a felony pursuant to ARS § 42-1127.B.2.

to criminal penalties of a felony pursuant to ARS § 42-1127.B.2.

I, (print full name) ______________________________________, hereby certify that these purchases are exempt from

I, (print full name) ______________________________________, hereby certify that these purchases are exempt from

Arizona transaction privilege tax and that the information on this Certifi cate is true, accurate and complete. Futher, if

Arizona transaction privilege tax and that the information on this Certifi cate is true, accurate and complete. Futher, if

purchasing as an agent, I certify that I have a duly executed written authorized to execute this Certifi cate on behalf of the

purchasing as an agent, I certify that I have a duly executed written authorized to execute this Certifi cate on behalf of the

purchaser named above.

purchaser named above.

Signature of purchaser

Signature of purchaser __________________________________________________________________

__________________________________________________________________ Date

Date _________________________

_________________________

Title

Title _________________________________________________________________________________________________________________

_________________________________________________________________________________________________________________

Exact reproductions and photocopies of this certifi cate are acceptable for use.

ADOR 20-2014 (4/02)

1

1