Instructions For Form St11p - Special Purchase Refund Claim - Minnesota Department Of Revenue

ADVERTISEMENT

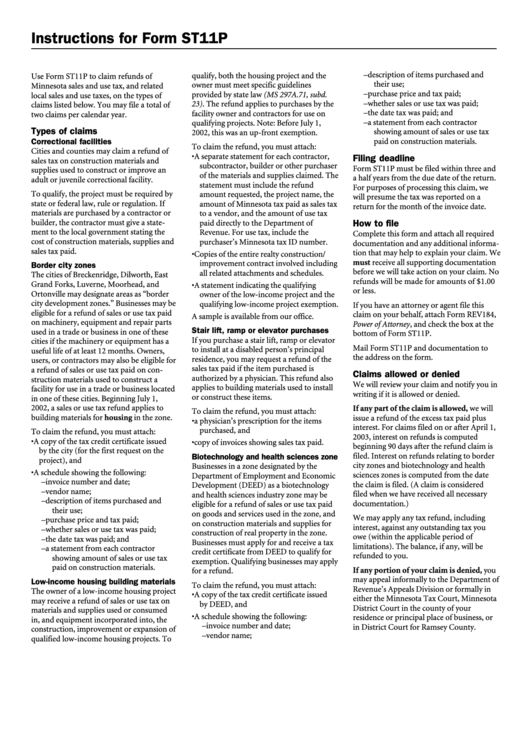

Instructions for Form ST11P

– description of items purchased and

qualify, both the housing project and the

Use Form ST11P to claim refunds of

their use;

owner must meet specific guidelines

Minnesota sales and use tax, and related

– purchase price and tax paid;

provided by state law (MS 297A.71, subd.

local sales and use taxes, on the types of

– whether sales or use tax was paid;

23). The refund applies to purchases by the

claims listed below. You may file a total of

– the date tax was paid; and

facility owner and contractors for use on

two claims per calendar year.

– a statement from each contractor

qualifying projects. Note: Before July 1,

Types of claims

showing amount of sales or use tax

2002, this was an up-front exemption.

paid on construction materials.

Correctional facilities

To claim the refund, you must attach:

Cities and counties may claim a refund of

• A separate statement for each contractor,

Filing deadline

sales tax on construction materials and

subcontractor, builder or other purchaser

Form ST11P must be filed within three and

supplies used to construct or improve an

of the materials and supplies claimed. The

a half years from the due date of the return.

adult or juvenile correctional facility.

statement must include the refund

For purposes of processing this claim, we

To qualify, the project must be required by

amount requested, the project name, the

will presume the tax was reported on a

state or federal law, rule or regulation. If

amount of Minnesota tax paid as sales tax

return for the month of the invoice date.

materials are purchased by a contractor or

to a vendor, and the amount of use tax

builder, the contractor must give a state-

paid directly to the Department of

How to file

ment to the local government stating the

Revenue. For use tax, include the

Complete this form and attach all required

cost of construction materials, supplies and

purchaser’s Minnesota tax ID number.

documentation and any additional informa-

sales tax paid.

tion that may help to explain your claim. We

• Copies of the entire realty construction/

must receive all supporting documentation

improvement contract involved including

Border city zones

before we will take action on your claim. No

all related attachments and schedules.

The cities of Breckenridge, Dilworth, East

refunds will be made for amounts of $1.00

Grand Forks, Luverne, Moorhead, and

• A statement indicating the qualifying

or less.

Ortonville may designate areas as “border

owner of the low-income project and the

city development zones.” Businesses may be

qualifying low-income project exemption.

If you have an attorney or agent file this

eligible for a refund of sales or use tax paid

claim on your behalf, attach Form REV184,

A sample is available from our office.

on machinery, equipment and repair parts

Power of Attorney, and check the box at the

Stair lift, ramp or elevator purchases

used in a trade or business in one of these

bottom of Form ST11P.

If you purchase a stair lift, ramp or elevator

cities if the machinery or equipment has a

Mail Form ST11P and documentation to

to install at a disabled person’s principal

useful life of at least 12 months. Owners,

the address on the form.

residence, you may request a refund of the

users, or contractors may also be eligible for

sales tax paid if the item purchased is

a refund of sales or use tax paid on con-

Claims allowed or denied

authorized by a physician. This refund also

struction materials used to construct a

We will review your claim and notify you in

applies to building materials used to install

facility for use in a trade or business located

writing if it is allowed or denied.

or construct these items.

in one of these cities. Beginning July 1,

2002, a sales or use tax refund applies to

If any part of the claim is allowed, we will

To claim the refund, you must attach:

building materials for housing in the zone.

issue a refund of the excess tax paid plus

• a physician’s prescription for the items

interest. For claims filed on or after April 1,

purchased, and

To claim the refund, you must attach:

2003, interest on refunds is computed

• A copy of the tax credit certificate issued

• copy of invoices showing sales tax paid.

beginning 90 days after the refund claim is

by the city (for the first request on the

filed. Interest on refunds relating to border

Biotechnology and health sciences zone

project), and

city zones and biotechnology and health

Businesses in a zone designated by the

• A schedule showing the following:

sciences zones is computed from the date

Department of Employment and Economic

– invoice number and date;

the claim is filed. (A claim is considered

Development (DEED) as a biotechnology

– vendor name;

filed when we have received all necessary

and health sciences industry zone may be

– description of items purchased and

documentation.)

eligible for a refund of sales or use tax paid

their use;

on goods and services used in the zone, and

We may apply any tax refund, including

– purchase price and tax paid;

on construction materials and supplies for

interest, against any outstanding tax you

– whether sales or use tax was paid;

construction of real property in the zone.

owe (within the applicable period of

– the date tax was paid; and

Businesses must apply for and receive a tax

limitations). The balance, if any, will be

– a statement from each contractor

credit certificate from DEED to qualify for

refunded to you.

showing amount of sales or use tax

exemption. Qualifying businesses may apply

paid on construction materials.

If any portion of your claim is denied, you

for a refund.

may appeal informally to the Department of

Low-income housing building materials

To claim the refund, you must attach:

Revenue’s Appeals Division or formally in

The owner of a low-income housing project

• A copy of the tax credit certificate issued

either the Minnesota Tax Court, Minnesota

may receive a refund of sales or use tax on

by DEED, and

District Court in the county of your

materials and supplies used or consumed

• A schedule showing the following:

residence or principal place of business, or

in, and equipment incorporated into, the

– invoice number and date;

in District Court for Ramsey County.

construction, improvement or expansion of

– vendor name;

qualified low-income housing projects. To

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1