City Of Los Angeles - Business Tax Application Form

ADVERTISEMENT

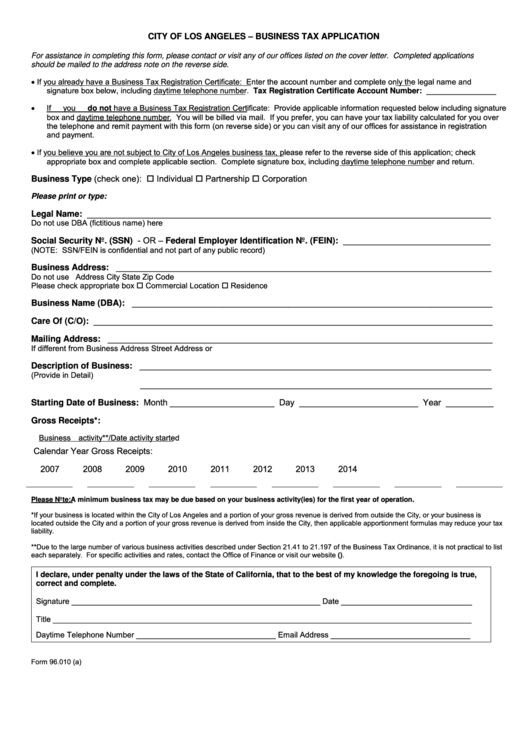

CITY OF LOS ANGELES – BUSINESS TAX APPLICATION

For assistance in completing this form, please contact or visit any of our offices listed on the cover letter. Completed applications

should be mailed to the address note on the reverse side.

If you already have a Business Tax Registration Certificate: Enter the account number and complete only the legal name and

signature box below, including daytime telephone number. Tax Registration Certificate Account Number: ________________

If you do not have a Business Tax Registration Certificate: Provide applicable information requested below including signature

box and daytime telephone number. You will be billed via mail. If you prefer, you can have your tax liability calculated for you over

the telephone and remit payment with this form (on reverse side) or you can visit any of our offices for assistance in registration

and payment.

If you believe you are not subject to City of Los Angeles business tax, please refer to the reverse side of this application; check

appropriate box and complete applicable section. Complete signature box, including daytime telephone number and return.

Business Type (check one):

Individual

Partnership

Corporation

Please print or type:

Legal Name: _____________________________________________________________________________________

Do not use DBA (fictitious name) here

Social Security No. (SSN) - OR – Federal Employer Identification No. (FEIN): _______________________________

(NOTE: SSN/FEIN is confidential and not part of any public record)

Business Address: _______________________________________________________________________________

Do not use P.O. Box here

Street Address

City

State

Zip Code

Please check appropriate box

Commercial Location

Residence

Business Name (DBA): ____________________________________________________________________________

Care Of (C/O): ____________________________________________________________________________________

Mailing Address: _________________________________________________________________________________

If different from Business Address

Street Address or P.O. Box

City

State

Zip Code

Description of Business: __________________________________________________________________________

(Provide in Detail)

__________________________________________________________________________

Starting Date of Business: Month ______________________ Day _________________________ Year __________

Gross Receipts*:

Business activity**/Date activity started

Calendar Year Gross Receipts:

2007

2008

2009

2010

2011

2012

2013

2014

Please Note: A minimum business tax may be due based on your business activity(ies) for the first year of operation.

*If your business is located within the City of Los Angeles and a portion of your gross revenue is derived from outside the City, or your business is

located outside the City and a portion of your gross revenue is derived from inside the City, then applicable apportionment formulas may reduce your tax

liability.

**Due to the large number of various business activities described under Section 21.41 to 21.197 of the Business Tax Ordinance, it is not practical to list

each separately. For specific activities and rates, contact the Office of Finance or visit our website ( ).

I declare, under penalty under the laws of the State of California, that to the best of my knowledge the foregoing is true,

correct and complete.

Signature _________________________________________________________ Date ______________________________

Title ________________________________________________________________________________________________

Daytime Telephone Number ________________________________ Email Address ________________________________

Form 96.010 (a)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2