City Of Los Angeles - Business Tax Application Form Page 2

ADVERTISEMENT

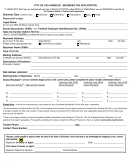

Payment information (if you prefer to make payment now and not be billed): Payment by mail can be made with a

check, money order or credit card. Cash is also accepted at our branch offices.

Payment by (Check one only)

Check

Mastercard

Visa

Discover

** No Split Payments**

Name on Credit Card ____________________________________________________________________________

Acct# ___ ___ ___ ___ – ___ ___ ___ ___ – ___ ___ ___ ___ – ___ ___ ___ ___

Exp Date ___ ___ / ___ ___

Amount Paid $ ________________ Authorized Signature ________________________________ Date ___________

Billing Address of Card Holder _____________________________________________________________________

_________________________________________________

Zip Code __________

For office use only — Auth # ______________________________________ Date Keyed ______________________

Make checks payable to “Office of Finance, City of Los Angeles” AND write your account number on your check

or money order. Send Payment to: City of Los Angeles, P.O. Box 53478, Los Angeles, CA 90053-0478

If you believe you are not subject to City of Los Angeles business tax, please complete this section, sign application in the

signature box on the front of this form and return by mail.

Physical business address is located outside the City of Los Angeles.

Please provide address:

___________________________________________________________________________________________

Street Address

City

State

Zip Code

Employee (not independent contractor). Please attach an Employee Certification Letter (copy available from branch

offices listed on letter or at ) or other proof of documentation such as a W-2.

Business operated less than 7 days in a calendar year in the City of Los Angeles. Please provide details:

___________________________________________________________________________________________

___________________________________________________________________________________________

Other. Please provide a written response explaining your position. Upon review of your response, you will be

removed from the database or contacted for additional information.

Important Notice for Credit Card Payments

American Express will no longer be accepted starting December 15, 2006. Visa, MasterCard and Discover will still be

accepted for payment.

A service free will be automatically assessed on all credit card and debit card transactions for tax payments starting

December 15, 2009. All Visa Debit Card Payments will be assessed a flat fee of $3.95 per transaction with a maximum

allowed payment of $1,200. All other Credit or Debit Card Payments will be assessed a fee equal to 2.7% of the payment

amount with a minimum fee of $3.95.

These tax payment options are provided through a third-party service. The City of Los Angeles does not receive any

portion of the service fee. The service fee will be included on the statement as a separate transaction from the payment

obligation due to the City of Los Angeles. Service fees cannot be reimbursed or refunded by either the City of Los

Angeles or the service provider.

Form 96.010 (a)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2