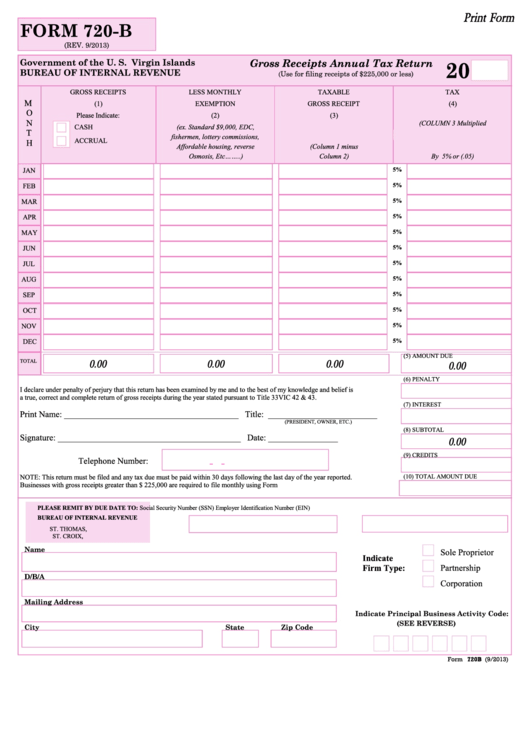

Print Form

FORM 720-B

(REV. 9/2013)

Government of the U. S. Virgin Islands

Gross Receipts Annual Tax Return

20

BUREAU OF INTERNAL REVENUE

Use for filing receipts of $225,000 or less)

(

GROSS RECEIPTS

LESS MONTHLY

TAXABLE

TAX

M

(1)

EXEMPTION

GROSS RECEIPT

(4)

O

Please Indicate:

(2)

(3)

N

(COLUMN 3 Multiplied

CASH

(ex. Standard $9,000, EDC,

T

fishermen, lottery commissions,

ACCRUAL

H

Affordable housing, reverse

(Column 1 minus

Osmosis, Etc……..)

Column 2)

By 5% or (.05)

5%

JAN

5%

FEB

5%

MAR

5%

APR

5%

MAY

5%

JUN

5%

JUL

5%

AUG

5%

SEP

5%

OCT

5%

NOV

5%

DEC

(5) AMOUNT DUE

0.00

0.00

0.00

0.00

TOTAL

(6) PENALTY

I declare under penalty of perjury that this return has been examined by me and to the best of my knowledge and belief is

a true, correct and complete return of gross receipts during the year stated pursuant to Title 33VIC 42 & 43.

(7) INTEREST

Print Name: ________________________________________ Title: _________________________

(PRESIDENT, OWNER, ETC.)

(8) SUBTOTAL

Signature: __________________________________________ Date: ________________

0.00

(9) CREDITS

Telephone Number:

-

-

NOTE: This return must be filed and any tax due must be paid within 30 days following the last day of the year reported.

(10) TOTAL AMOUNT DUE

Businesses with gross receipts greater than $ 225,000 are required to file monthly using Form 720V.I.

PLEASE REMIT BY DUE DATE TO:

Employer Identification Number (EIN)

Social Security Number (SSN)

BUREAU OF INTERNAL REVENUE

ST. THOMAS, U.S.V.I. 00802

ST. CROIX, U.S.V.I. 00820

Name

Sole Proprietor

Indicate

Firm Type:

Partnership

D/B/A

Corporation

Mailing Address

Indicate Principal Business Activity Code:

(SEE REVERSE)

City

State

Zip Code

Form 720B (9/2013)

1

1 2

2