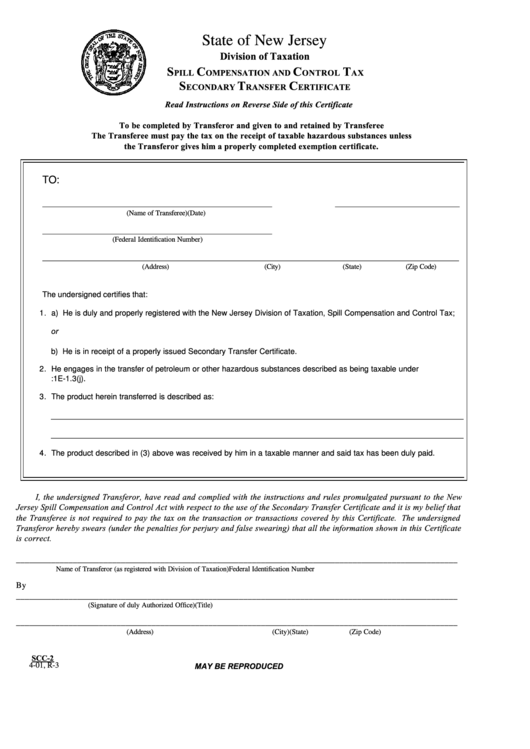

State of New Jersey

Division of Taxation

S

C

C

T

PILL

OMPENSATION AND

ONTROL

AX

S

T

C

ECONDARY

RANSFER

ERTIFICATE

Read Instructions on Reverse Side of this Certificate

To be completed by Transferor and given to and retained by Transferee

The Transferee must pay the tax on the receipt of taxable hazardous substances unless

the Transferor gives him a properly completed exemption certificate.

TO:

___________________________________________________________

________________________________

(Name of Transferee)

(Date)

___________________________________________________________

(Federal Identification Number)

___________________________________________________________________________________________________________

(Address)

(City)

(State)

(Zip Code)

The undersigned certifies that:

1. a) He is duly and properly registered with the New Jersey Division of Taxation, Spill Compensation and Control Tax;

or

b) He is in receipt of a properly issued Secondary Transfer Certificate.

2. He engages in the transfer of petroleum or other hazardous substances described as being taxable under

N.J.A.C.7:1E-1.3(j).

3. The product herein transferred is described as:

______________________________________________________________________________________________

______________________________________________________________________________________________

4. The product described in (3) above was received by him in a taxable manner and said tax has been duly paid.

I, the undersigned Transferor, have read and complied with the instructions and rules promulgated pursuant to the New

Jersey Spill Compensation and Control Act with respect to the use of the Secondary Transfer Certificate and it is my belief that

the Transferee is not required to pay the tax on the transaction or transactions covered by this Certificate. The undersigned

Transferor hereby swears (under the penalties for perjury and false swearing) that all the information shown in this Certificate

is correct.

_____________________________________________________________________________________________________

Name of Transferor (as registered with Division of Taxation)

Federal Identification Number

By

_____________________________________________________________________________________________________

(Signature of duly Authorized Office)

(Title)

_____________________________________________________________________________________________________

(Address)

(City)

(State)

(Zip Code)

SCC-2

MAY BE REPRODUCED

4-01, R-3

1

1 2

2