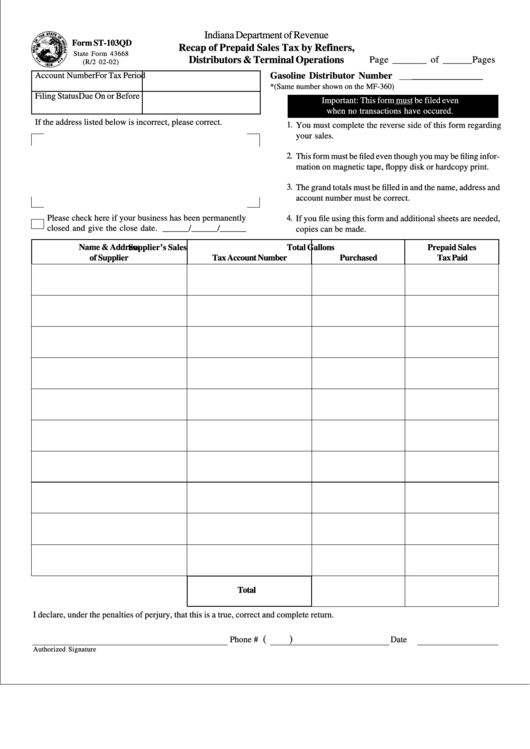

Form St-103qd Recap Of Prepaid Sales Tax By Refiners, Distributors & Terminal Operations

ADVERTISEMENT

Indiana Department of Revenue

Form ST-103QD

Recap of Prepaid Sales Tax by Refiners,

State Form 43668

Distributors & Terminal Operations

Page _______ of ______Pages

(R/2 02-02)

Account Number

For Tax Period

Gasoline Distributor Number

_______________

*(Same number shown on the MF-360)

Filing Status

Due On or Before

Important: This form must be filed even

*

when no transactions have occured.

If the address listed below is incorrect, please correct.

1.

You must complete the reverse side of this form regarding

your sales.

2.

This form must be filed even though you may be filing infor-

mation on magnetic tape, floppy disk or hardcopy print.

3.

The grand totals must be filled in and the name, address and

account number must be correct.

Please check here if your business has been permanently

4.

If you file using this form and additional sheets are needed,

closed and give the close date. ______/______/______

copies can be made.

Name & Address

Supplier’s Sales

Total Gallons

Prepaid Sales

of Supplier

Tax Account Number

Purchased

Tax Paid

Total

I declare, under the penalties of perjury, that this is a true, correct and complete return.

(

)

Phone #

Date

Authorized Signature

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2