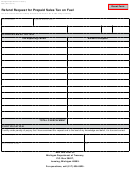

Form St-103qd Recap Of Prepaid Sales Tax By Refiners, Distributors & Terminal Operations Page 2

ADVERTISEMENT

(Attach additional sheets if necessary.)

Company Name

Sales Tax

Total

Exempt

Prepaid Tax

and Address

Account Number

Gallons

Gallons

Collected

Total

Form ST-103QD Instructions

On the front of this form, report must include information on all purchases made during the month.

M

Name & Address of Supplier: List the names and addresses of the company(s) from whom purchases were made.

M

Supplier’s Sales Tax Account Number: List the supplier’s prepaid sales tax number if applicable.

M

Total Gallons Purchased: List the total gallons purchased (exempt and taxable).

M

Prepaid Sales Tax Paid: List the amount of Prepaid Sales Tax that was paid, if none enter zero.

M

Total: Total the number of gallons purchased and prepaid sales tax paid.

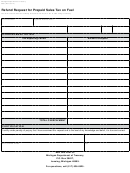

On the back of this form, please provide:

M

Company Name & Address: List names and addresses of the company(s) to whom sales were made.

M

Sales Tax Account Number: List customer’s Indiana sales tax account number.

M

Total Gallons: List the total gallons sold (exempt and taxable).

M

Exempt Gallons: List all the exempt gallons sold in Indiana including all gallons exported, if none enter zero.

M

Prepaid Tax Collected: List the amount of prepaid sales collected and tax passed on to your customer. Enter zero (0) if there was none

collected. Please verify that the exemption certificate on file for your exempt customers is the Prepaid Sales Tax Exemption Certificate

(PP-005A). Sales to customers where the PP-005A has been accepted must be listed on this form.

M

Total: Total the amounts of “Total Gallons,” “Exempt Gallons,” and “Prepaid Tax Collected.”

Note: The nonqualified distributor must obtain a Prepaid Sales Tax Collection and Remittance Permit to be exempt from the requirement

of prepaying the gross retail tax, as evidenced by a purchaser’s exemption certificate issued by the Department.

If you have any questions, you may call (317) 232-3524 or write the Department at the address listed below:

Indiana Department of Revenue, 100 N. Senate Ave, IGCN #203, Indianapolis, IN 46204

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2