Administrative Appeal Pursuant To Va. Code 58.1-1821 Form

ADVERTISEMENT

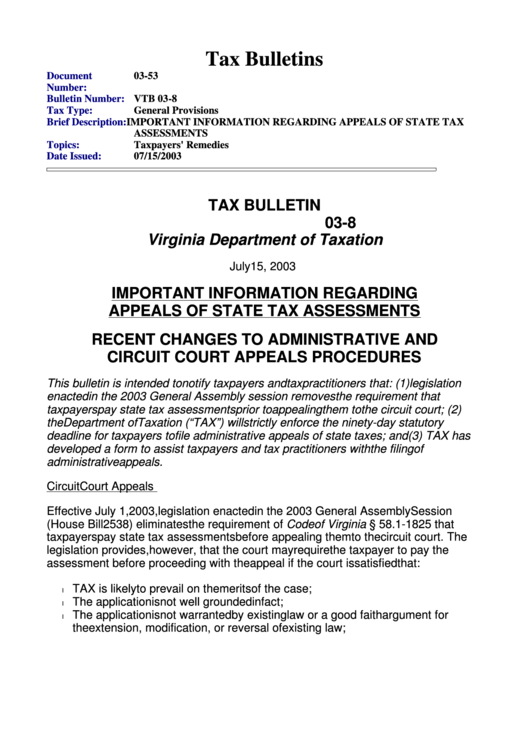

Tax Bulletins

Document

03-53

Number:

Bulletin Number:

VTB 03-8

Tax Type:

General Provisions

Brief Description:

IMPORTANT INFORMATION REGARDING APPEALS OF STATE TAX

ASSESSMENTS

Topics:

Taxpayers' Remedies

Date Issued:

07/15/2003

TAX BULLETIN

03-8

Virginia Department of Taxation

July 15, 2003

IMPORTANT INFORMATION REGARDING

APPEALS OF STATE TAX ASSESSMENTS

RECENT CHANGES TO ADMINISTRATIVE AND

CIRCUIT COURT APPEALS PROCEDURES

This bulletin is intended to notify taxpayers and tax practitioners that: (1) legislation

enacted in the 2003 General Assembly session removes the requirement that

taxpayers pay state tax assessments prior to appealing them to the circuit court; (2)

the Department of Taxation (“TAX”) will strictly enforce the ninety-day statutory

deadline for taxpayers to file administrative appeals of state taxes; and (3) TAX has

developed a form to assist taxpayers and tax practitioners with the filing of

administrative appeals.

Circuit Court Appeals

Effective July 1, 2003, legislation enacted in the 2003 General Assembly Session

(House Bill 2538) eliminates the requirement of Code of Virginia § 58.1-1825 that

taxpayers pay state tax assessments before appealing them to the circuit court. The

legislation provides, however, that the court may require the taxpayer to pay the

assessment before proceeding with the appeal if the court is satisfied that:

TAX is likely to prevail on the merits of the case;

l

The application is not well grounded in fact;

l

The application is not warranted by existing law or a good faith argument for

l

the extension, modification, or reversal of existing law;

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4