Waste Tire Reporting Form

ADVERTISEMENT

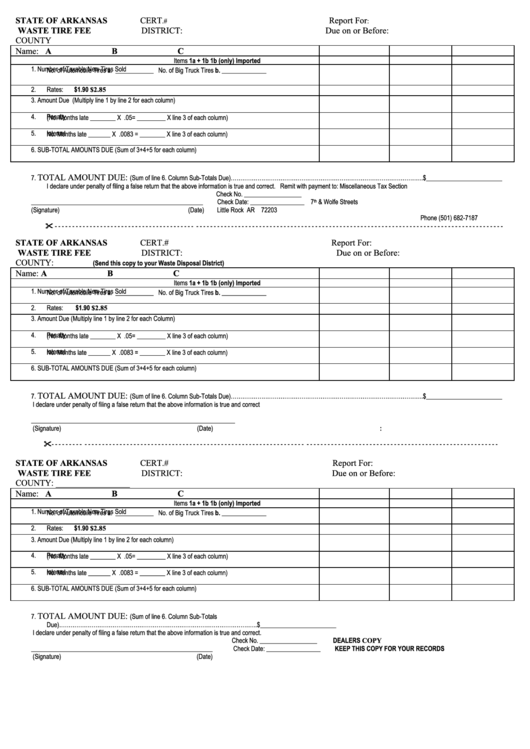

STATE OF ARKANSAS

CERT

Report For

.#

:

WASTE TIRE FEE

DISTRICT:

Due on or Before:

COUNTY

Name:

A

B

C

Items

1a + 1b

1b (only)

Imported

1.

Number of Taxable New Tires Sold

No. of Automobile Tires a. ____________ No. of Big Truck Tires b. ______________

2.

Rates:

$1.90

$2.85

3.

Amount Due (Multiply line 1 by line 2 for each column)

4.

Penalty

(No. Months late ________ X .05= _________ X line 3 of each column)

5.

Interest

No. Months late _______ X .0083 = ________ X line 3 of each column)

6.

SUB-TOTAL AMOUNTS DUE (Sum of 3+4+5 for each column)

TOTAL AMOUNT DUE:

7.

(Sum of line 6. Column Sub-Totals Due)………………………………………………………………………………………..$________________________

I declare under penalty of filing a false return that the above information is true and correct.

Remit with payment to: Miscellaneous Tax Section

Check No. __________________

P.O. Box 896 Room 2340

______________________________________________________

Check Date: _________________

7

& Wolfe Streets

th

(Signature)

(Date)

Little Rock AR 72203

Phone (501) 682-7187

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

STATE OF ARKANSAS

CERT.#

Report For:

WASTE TIRE FEE

DISTRICT:

Due on or Before:

COUNTY:

(Send this copy to your Waste Disposal District)

Name:

A

B

C

Items

1a + 1b

1b (only)

Imported

1.

Number of Taxable New Tires Sold

No. of Automobile Tires a. ____________ No. of Big Truck Tires b. ______________

2.

Rates:

$1.90

$2.85

3.

Amount Due (Multiply line 1 by line 2 for each Column)

4.

Penalty

(No. Months late ________ X .05= _________ X line 3 of each column)

5.

Interest

No. Months late _______ X .0083 = ________ X line 3 of each column)

6.

SUB-TOTAL AMOUNTS DUE (Sum of 3+4+5 for each column)

TOTAL AMOUNT DUE:

7.

(Sum of line 6. Column Sub-Totals Due)………………………………………………………………………………………..$________________________

I declare under penalty of filing a false return that the above information is true and correct

________________________________________________________________

(Signature)

(Date)

:

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

STATE OF ARKANSAS

CERT.#

Report For:

WASTE TIRE FEE

DISTRICT:

Due on or Before:

COUNTY: _________________

Name:

A

B

C

Items

1a + 1b

1b (only)

Imported

1.

Number of Taxable New Tires Sold

No. of Automobile Tires a. ____________ No. of Big Truck Tires b. ______________

2.

Rates:

$1.90

$2.85

3.

Amount Due (Multiply line 1 by line 2 for each column)

4.

Penalty

(No. Months late ________ X .05= _________ X line 3 of each column)

5.

Interest

No. Months late _______ X .0083 = ________ X line 3 of each column)

6.

SUB-TOTAL AMOUNTS DUE (Sum of 3+4+5 for each column)

TOTAL AMOUNT DUE:

7.

(Sum of line 6. Column Sub-Totals

Due)…………………………………………………………………………………………..$________________________

I declare under penalty of filing a false return that the above information is true and correct.

Check No. __________________

DEALERS COPY

_________________________________________________________

Check Date: _________________

KEEP THIS COPY FOR YOUR RECORDS

(Signature)

(Date)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1