Form 656 - Offer In Compromise

Download a blank fillable Form 656 - Offer In Compromise in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Form 656 - Offer In Compromise with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

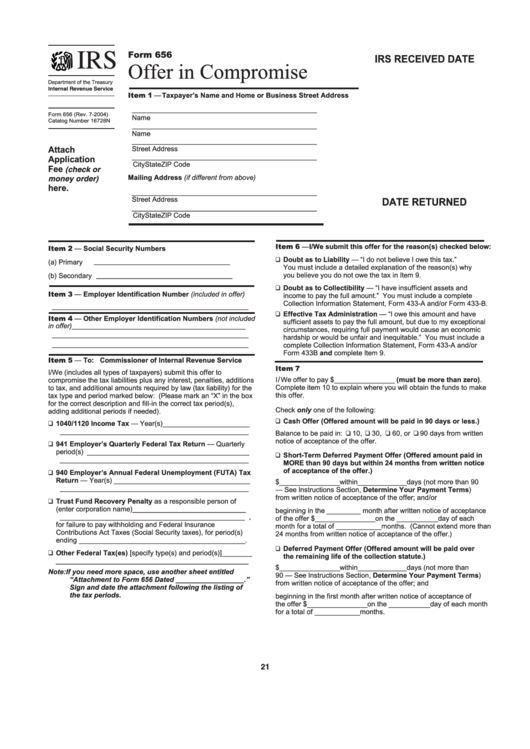

IRS

Form 656

IRS RECEIVED DATE

Offer in Compromise

Department of the Treasury

Internal Revenue Service

Item 1 — Taxpayer’s Name and Home or Business Street Address

_________________________________________________

Form 656 (Rev. 7-2004)

Name

Catalog Number 16728N

_________________________________________________

Name

_________________________________________________

Attach

Street Address

_________________________________________________

Application

City

State

ZIP Code

Fee

(check or

Mailing Address (if different from above)

money order)

here.

_________________________________________________

Street Address

DATE RETURNED

_________________________________________________

City

State

ZIP Code

Item 6 — I/We submit this offer for the reason(s) checked below:

Item 2 — Social Security Numbers

❑ Doubt as to Liability — “I do not believe I owe this tax.”

____________________________________

(a) Primary

You must include a detailed explanation of the reason(s) why

____________________________________

you believe you do not owe the tax in Item 9.

(b) Secondary

❑ Doubt as to Collectibility — “I have insufficient assets and

Item 3 — Employer Identification Number (included in offer)

income to pay the full amount.” You must include a complete

Collection Information Statement, Form 433-A and/or Form 433-B.

____________________________________________________

❑ Effective Tax Administration — “I owe this amount and have

Item 4 — Other Employer Identification Numbers (not included

sufficient assets to pay the full amount, but due to my exceptional

in offer) ______________________________________________

circumstances, requiring full payment would cause an economic

____________________________________________________

hardship or would be unfair and inequitable.” You must include a

____________________________________________________

complete Collection Information Statement, Form 433-A and/or

Form 433B and complete Item 9.

Item 5 — To: Commissioner of Internal Revenue Service

Item 7

I/We (includes all types of taxpayers) submit this offer to

/

I

We offer to pay $ ________________ (must be more than zero).

compromise the tax liabilities plus any interest, penalties, additions

to tax, and additional amounts required by law (tax liability) for the

Complete item 10 to explain where you will obtain the funds to make

this offer.

tax type and period marked below: (Please mark an “X” in the box

for the correct description and fill-in the correct tax period(s),

Check only one of the following:

adding additional periods if needed).

❑ Cash Offer (Offered amount will be paid in 90 days or less.)

❑ 1040/1120 Income Tax — Year(s) _______________________

__________________________________________________

Balance to be paid in: ❑ 10, ❑ 30, ❑ 60, or ❑ 90 days from written

notice of acceptance of the offer.

❑ 941 Employer’s Quarterly Federal Tax Return — Quarterly

period(s) ___________________________________________

❑ Short-Term Deferred Payment Offer (Offered amount paid in

__________________________________________________

MORE than 90 days but within 24 months from written notice

❑ 940 Employer’s Annual Federal Unemployment (FUTA) Tax

of acceptance of the offer.)

Return — Year(s) ____________________________________

$________________within_____________days (not more than 90

__________________________________________________

— See Instructions Section, Determine Your Payment Terms)

from written notice of acceptance of the offer; and/or

❑ Trust Fund Recovery Penalty as a responsible person of

(enter corporation name) ______________________________

beginning in the _________ month after written notice of acceptance

_________________________________________________ ,

of the offer $________________on the ___________day of each

for failure to pay withholding and Federal Insurance

month for a total of ____________months. (Cannot extend more than

Contributions Act Taxes (Social Security taxes), for period(s)

24 months from written notice of acceptance of the offer.)

ending ____________________________________________ .

❑ Deferred Payment Offer (Offered amount will be paid over

❑ Other Federal Tax(es) [specify type(s) and period(s)] ________

the remaining life of the collection statute.)

___________________________________________________

$________________within_____________days (not more than

Note: If you need more space, use another sheet entitled

90 — See Instructions Section, Determine Your Payment Terms)

“Attachment to Form 656 Dated _________________ .”

from written notice of acceptance of the offer; and

Sign and date the attachment following the listing of

the tax periods.

beginning in the first month after written notice of acceptance of

the offer $________________on the ___________day of each month

for a total of ____________months.

21

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4