Form Ap-100-2 - Sales Tax Permit/use Tax Permit/mixed Beverage Tax Account Set-Up

ADVERTISEMENT

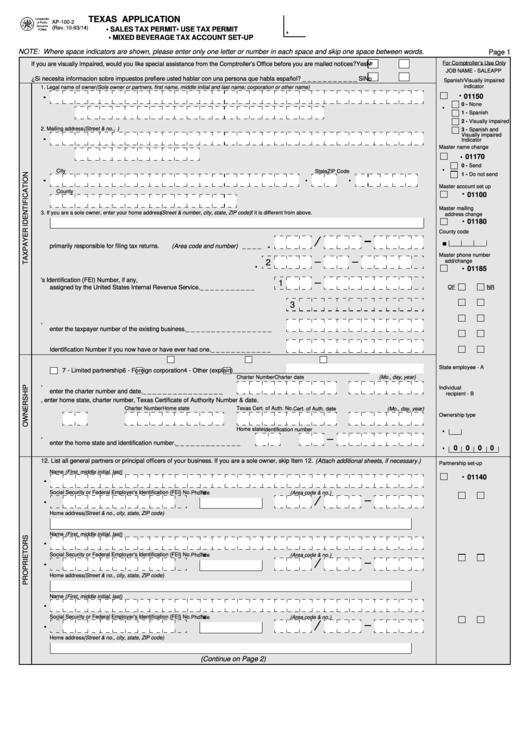

TEXAS APPLICATION

AP-100-2

(Rev. 10-93/14)

• SALES TAX PERMIT

• USE TAX PERMIT

• MIXED BEVERAGE TAX ACCOUNT SET-UP

NOTE: Where space indicators are shown, please enter only one letter or number in each space and skip one space between words.

Page 1

For Comptroller’s Use Only

If you are visually impaired, would you like special assistance from the Comptroller’s Office before you are mailed notices?

Yes

No

JOB NAME - SALEAPP

¿Si necesita informacion sobre impuestos prefiere usted hablar con una persona que habla español? _ _ _ _ _ _ _ _ _ _ _

Si

No

Spanish/Visually impaired

indicator

1. Legal name of owner (Sole owner or partners, first name, middle initial and last name; corporation or other name)

01150

0 - None

1 - Spanish

2 - Visually impaired

2. Mailing address (Street & no., P.O. Box or Rural Route and box no.)

3 - Spanish and

Visually impaired

Indicator

Master name change

01170

0 - Send

City

State

ZIP Code

1 - Do not send

Master account set up

County

01100

Master mailing

3. If you are a sole owner, enter your home address (Street & number, city, state, ZIP code) if it is different from above.

address change

01180

County code

3a. Enter the daytme phone number of the person

primarily responsible for filing tax returns.

(Area code and number) _ _ _ _

Master phone number

2

add/change

4. Enter your Social Security Number if you are a sole owner. _ _ _ _ _ _ _

01185

5. Enter your Federal Employer's Identification (FEI) Number, if any,

1

assigned by the United States Internal Revenue Service. _ _ _ _ _ _ _ _ _ _ _

OF

NR

3

6. If you are incorporating an existing business,

enter the taxpayer number of the existing business. _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

7. Enter your taxpayer number for reporting any Texas tax OR your Texas Vendor

Identification Number if you now have or have ever had one. _ _ _ _ _ _ _ _ _ _ _ _

8. Indicate how your business is owned.

1 - Sole owner

2 - Partnership

3 - Texas corporation

State employee - A

7 - Limited partnership

6 - Foreign corporation

4 - Other (explain) ________________________________________

Charter Number

Charter date (Mo., day, year)

9. If your business is a Texas corporation,

Individual

enter the charter number and date. _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

recipient - B

10. If your business is a foreign corporation, enter home state, charter number, Texas Certificate of Authority Number & date.

Home state

Charter Number

Texas Cert. of Auth. No.

Cert. of Auth. date (Mo., day, year)

Ownership type

Home state

Identification number

11. If your business is a limited partnership,

enter the home state and identification number. _ _ _ _ _ _ _ _ _ _ _ _ _

0

0

0 0

12. List all general partners or principal officers of your business. If you are a sole owner, skip Item 12. (Attach additional sheets, if necessary.)

Partnership set-up

Name (First, middle initial, last)

01140

Social Security or Federal Employer's Identification (FEI) No.

Title

Phone (Area code & no.)

Home address (Street & no., city, state, ZIP code)

Name (First, middle initial, last)

Social Security or Federal Employer's Identification (FEI) No.

Title

Phone (Area code & no.)

Home address (Street & no., city, state, ZIP code)

Name (First, middle initial, last)

Social Security or Federal Employer's Identification (FEI) No.

Title

Phone (Area code & no.)

Home address (Street & no., city, state, ZIP code)

(Continue on Page 2)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3