Texas Application Mixed Beverage Tax Account Set-Up / Sales Tax Permit / Use Tax Permit (Ap-100-1) Instructions

ADVERTISEMENT

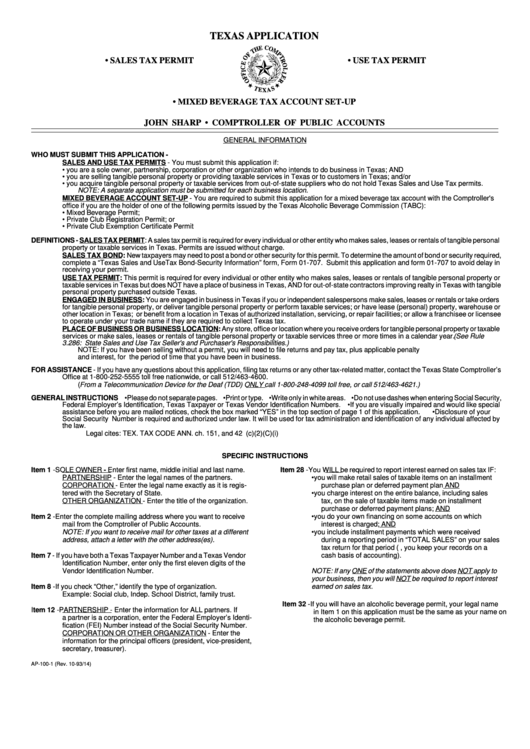

TEXAS APPLICATION

• SALES TAX PERMIT

• USE TAX PERMIT

• MIXED BEVERAGE TAX ACCOUNT SET-UP

JOHN SHARP • COMPTROLLER OF PUBLIC ACCOUNTS

GENERAL INFORMATION

WHO MUST SUBMIT THIS APPLICATION -

SALES AND USE TAX PERMITS - You must submit this application if:

• you are a sole owner, partnership, corporation or other organization who intends to do business in Texas; AND

• you are selling tangible personal property or providing taxable services in Texas or to customers in Texas; and/or

• you acquire tangible personal property or taxable services from out-of-state suppliers who do not hold Texas Sales and Use Tax permits.

NOTE: A separate application must be submitted for each business location.

MIXED BEVERAGE ACCOUNT SET-UP - You are required to submit this application for a mixed beverage tax account with the Comptroller's

office if you are the holder of one of the following permits issued by the Texas Alcoholic Beverage Commission (TABC):

• Mixed Beverage Permit;

• Private Club Registration Permit; or

• Private Club Exemption Certificate Permit

DEFINITIONS - SALES TAX PERMIT: A sales tax permit is required for every individual or other entity who makes sales, leases or rentals of tangible personal

property or taxable services in Texas. Permits are issued without charge.

SALES TAX BOND: New taxpayers may need to post a bond or other security for this permit. To determine the amount of bond or security required,

complete a “Texas Sales and UseTax Bond-Security Information” form, Form 01-707. Submit this application and form 01-707 to avoid delay in

receiving your permit.

USE TAX PERMIT: This permit is required for every individual or other entity who makes sales, leases or rentals of tangible personal property or

taxable services in Texas but does NOT have a place of business in Texas, AND for out-of-state contractors improving realty in Texas with tangible

personal property purchased outside Texas.

ENGAGED IN BUSINESS: You are engaged in business in Texas if you or independent salespersons make sales, leases or rentals or take orders

for tangible personal property, or deliver tangible personal property or perform taxable services; or have lease (personal) property, warehouse or

other location in Texas; or benefit from a location in Texas of authorized installation, servicing, or repair facilities; or allow a franchisee or licensee

to operate under your trade name if they are required to collect Texas tax.

PLACE OF BUSINESS OR BUSINESS LOCATION: Any store, office or location where you receive orders for tangible personal property or taxable

services or make sales, leases or rentals of tangible personal property or taxable services three or more times in a calendar year. (See Rule

3.286: State Sales and Use Tax Seller's and Purchaser's Responsibilities.)

NOTE: If you have been selling without a permit, you will need to file returns and pay tax, plus applicable penalty

and interest, for the period of time that you have been in business.

FOR ASSISTANCE - If you have any questions about this application, filing tax returns or any other tax-related matter, contact the Texas State Comptroller’s

Office at 1-800-252-5555 toll free nationwide, or call 512/463-4600.

( From a Telecommunication Device for the Deaf (TDD) ONLY call 1-800-248-4099 toll free, or call 512/463-4621.)

GENERAL INSTRUCTIONS •Please do not separate pages. •Print or type. •Write only in white areas. •Do not use dashes when entering Social Security,

Federal Employer’s Identification, Texas Taxpayer or Texas Vendor Identification Numbers. •If you are visually impaired and would like special

assistance before you are mailed notices, check the box marked “YES” in the top section of page 1 of this application.

•Disclosure of your

Social Security Number is required and authorized under law. It will be used for tax administration and identification of any individual affected by

the law.

Legal cites: TEX. TAX CODE ANN. ch. 151, and 42 U.S.C.A. sec. 405 (c)(2)(C)(i)

SPECIFIC INSTRUCTIONS

Item 1 - SOLE OWNER - Enter first name, middle initial and last name.

Item 28 - You WILL be required to report interest earned on sales tax IF:

PARTNERSHIP - Enter the legal names of the partners.

•

you will make retail sales of taxable items on an installment

CORPORATION - Enter the legal name exactly as it is regis-

purchase plan or deferred payment plan AND

tered with the Secretary of State.

•

you charge interest on the entire balance, including sales

OTHER ORGANIZATION - Enter the title of the organization.

tax, on the sale of taxable items made on installment

purchase or deferred payment plans; AND

Item 2 - Enter the complete mailing address where you want to receive

•

you do your own financing on some accounts on which

mail from the Comptroller of Public Accounts.

interest is charged; AND

NOTE: If you want to receive mail for other taxes at a different

•

you include installment payments which were received

address, attach a letter with the other address(es).

during a reporting period in “TOTAL SALES” on your sales

tax return for that period (i.e., you keep your records on a

Item 7 -

If you have both a Texas Taxpayer Number and a Texas Vendor

cash basis of accounting).

Identification Number, enter only the first eleven digits of the

Vendor Identification Number.

NOTE: If any ONE of the statements above does NOT apply to

your business, then you will NOT be required to report interest

earned on sales tax.

Item 8 - If you check “Other,” identify the type of organization.

Example: Social club, Indep. School District, family trust.

Item 32 - If you will have an alcoholic beverage permit, your legal name

Item 12 - PARTNERSHIP - Enter the information for ALL partners. If

in Item 1 on this application must be the same as your name on

a partner is a corporation, enter the Federal Employer’s Identi-

the alcoholic beverage permit.

fication (FEI) Number instead of the Social Security Number.

CORPORATION OR OTHER ORGANIZATION - Enter the

information for the principal officers (president, vice-president,

secretary, treasurer).

AP-100-1 (Rev. 10-93/14)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1