QUESTIONS AND ANSWERS ABOUT THE EARNED INCOME TAX

WHAT IS THE "EARNED INCOME TAX?"

The Earned Income Tax, commonly called a "Wage Tax", is usually a tax of one percent (1%) on gross wages and/or net

profits from a business or profession. In Home Rule communities, the tax rate may vary and can even be higher than one

percent (1%). Typically, individuals who receive "earned income", including salaries, wages, commissions, bonuses,

incentive payments, fees, tips and/or other compensation for services rendered, whether in cash or property, are subject to

the tax. In addition, those who conduct businesses, professions and other activities for profit must pay tax on the net profit

derived from their operation after deductions have been made of all costs and expenses incurred in conducting said

businesses.

WHAT INCOME IS SPECIFICALLY EXEMPT FROM THE EARNED INCOME TAX?

Unearned income such as dividends, interest, income from trusts, bonds, insurance and stocks in exempt. Also exempt are

payments for sick or disability benefits, old age benefits, retirement pay, pensions - including social security payments,

public assistance or unemployment compensation payments made by any governmental agency, and any wages or

compensation paid by the United States for active service in the forces of the United States including bonuses or additional

compensation for such service. In addition, net profits of corporations are exempt under state law.

IF THE TAX IS WITHHELD IN ANOTHER COMMUNITY WHERE I WORK, DO I ALSO PAY THE DISTRICT

IN WHICH I LIVE?

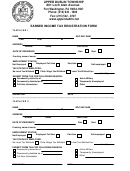

No, the tax withheld by your employer will be remitted to your resident taxing jurisdiction. It is still required that our

Registration Form be answered by ALL residents.

WHOSE EARNED INCOME TAX WILL BE WITHHELD BY THEIR EMPLOYER?

Any individual working in a jurisdiction that levies the tax will have the tax withheld by their employer. Occasionally,

employers located in a jurisdiction where the tax is not levied will volunteer to withhold if your resident jurisdiction levies

the tax.

FROM WHOM WILL THE EARNED INCOME TAX BE COLLECTED DIRECTLY?

The earned income tax will be collected directly from those who are: 1) self-employed; 2) salaried but self -employed in a

side business; or 3) work in a municipality where the tax is not in place. Those persons must file a declaration of the total of

such estimated net profits or income, together with the total estimated tax due, with the Earned Income Tax Collector.

Proper forms for reporting the quarterly payments will be sent to each person so liable.

MUST ALL TAXPAYERS FILE A FINAL RETURN?

Yes.

WHAT HAPPENS IF I NEITHER FILE A RETURN NOR PAY THE TAX DUE?

State law, as well as the local tax resolutions and/or ordinances, make it a summary criminal offense if a taxpayer fails to file

a tax return as required, and subjects the taxpayer to a fine not to exceed $500.00 per offense, plus the cost of prosecution; in

default of payment of said fine and costs, the taxpayer may be imprisoned for a period not exceeding thirty (30) days per

offense. In addition, distress sale, wage attachment and/or civil suit proceedings may be used to collect any unpaid tax found

to be due, and penalties and interest may also be assessed.

1

1 2

2