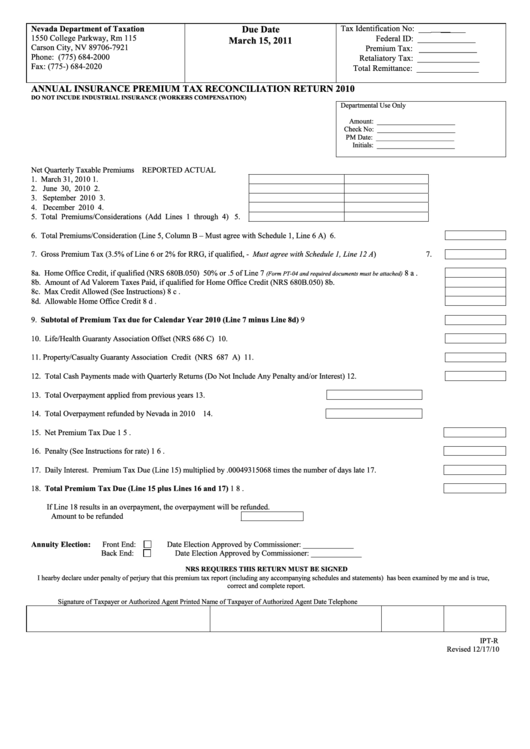

Form Ipt-R - Annual Insurance Premium Tax Reconciliation Return 2010

ADVERTISEMENT

Tax Identification No: ___

______

Nevada Department of Taxation

Due Date

1550 College Parkway, Rm 115

Federal ID: ______________

March 15, 2011

Carson City, NV 89706-7921

Premium Tax: ______________

Phone: (775) 684-2000

Retaliatory Tax: _______________

Fax: (775-) 684-2020

Total Remittance: _______________

ANNUAL INSURANCE PREMIUM TAX RECONCILIATION RETURN 2010

DO NOT INCUDE INDUSTRIAL INSURANCE (WORKERS COMPENSATION)

Departmental Use Only

Amount: ______________________

Check No: ______________________

PM Date: ______________________

Initials: ______________________

Net Quarterly Taxable Premiums

REPORTED

ACTUAL

1. March 31, 2010

1.

2. June 30, 2010

2.

3. September 2010

3.

4. December 2010

4.

5. Total Premiums/Considerations (Add Lines 1 through 4)

5.

6. Total Premiums/Consideration (Line 5, Column B – Must agree with Schedule 1, Line 6 A)

6.

7. Gross Premium Tax (3.5% of Line 6 or 2% for RRG, if qualified, - Must agree with Schedule 1, Line 12 A)

7.

8a. Home Office Credit, if qualified (NRS 680B.050) 50% or .5 of Line 7

8a.

(Form PT-04 and required documents must be attached)

8b. Amount of Ad Valorem Taxes Paid, if qualified for Home Office Credit (NRS 680B.050)

8b.

8c. Max Credit Allowed (See Instructions)

8c.

8d. Allowable Home Office Credit

8d.

9. Subtotal of Premium Tax due for Calendar Year 2010 (Line 7 minus Line 8d)

9

10. Life/Health Guaranty Association Offset (NRS 686 C)

10.

11. Property/Casualty Guaranty Association Credit (NRS 687 A)

11.

12. Total Cash Payments made with Quarterly Returns (Do Not Include Any Penalty and/or Interest)

12.

13. Total Overpayment applied from previous years

13.

14. Total Overpayment refunded by Nevada in 2010

14.

15. Net Premium Tax Due

15.

16. Penalty (See Instructions for rate)

16.

17. Daily Interest. Premium Tax Due (Line 15) multiplied by .00049315068 times the number of days late

17.

18. Total Premium Tax Due (Line 15 plus Lines 16 and 17)

18.

If Line 18 results in an overpayment, the overpayment will be refunded.

Amount to be refunded

Annuity Election:

Front End:

Date Election Approved by Commissioner: _____________

Back End:

Date Election Approved by Commissioner: _____________

NRS REQUIRES THIS RETURN MUST BE SIGNED

I hearby declare under penalty of perjury that this premium tax report (including any accompanying schedules and statements) has been examined by me and is true,

correct and complete report.

Signature of Taxpayer or Authorized Agent

Printed Name of Taxpayer of Authorized Agent

Date

Telephone

IPT-R

Revised 12/17/10

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5