Reset Form

Print Form

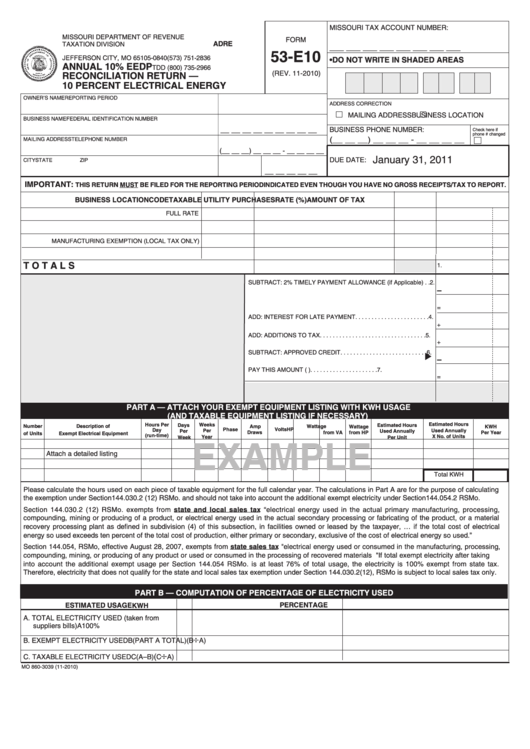

MISSOURI TAX ACCOUNT NUMBER:

MISSOURI DEPARTMENT OF REVENUE

FORM

ADRE

TAXATION DIVISION

___ ___ ___ ___ ___ ___ ___ ___

P.O. BOX 840

53-E10

JEFFERSON CITY, MO 65105-0840

(573) 751-2836

• DO NOT WRITE IN SHADED AREAS

ANNUAL 10% EEDP

TDD (800) 735-2966

(REV. 11-2010)

RECONCILIATION RETURN —

10 PERCENT ELECTRICAL ENERGY

OWNER’S NAME

REPORTING PERIOD

ADDRESS CORRECTION

MAILING ADDRESS

BUSINESS LOCATION

BUSINESS NAME

FEDERAL IDENTIFICATION NUMBER

__ __ __ __ __ __ __ __ __

BUSINESS PHONE NUMBER:

Check here if

phone # changed

(__ __ __) __ __ __ - __ __ __ __

MAILING ADDRESS

TELEPHONE NUMBER

(__ __ __) __ __ __ - __ __ __ __

January 31, 2011

DUE DATE:

CITY

STATE

ZIP

__ __ __ __ __

IMPORTANT:

THIS RETURN MUST BE FILED FOR THE REPORTING PERIOD INDICATED EVEN THOUGH YOU HAVE NO GROSS RECEIPTS/TAX TO REPORT.

BUSINESS LOCATION

CODE

TAXABLE UTILITY PURCHASES

RATE (%)

AMOUNT OF TAX

FULL RATE

MANUFACTURING EXEMPTION (LOCAL TAX ONLY)

TOTALS . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1.

SUBTRACT: 2% TIMELY PAYMENT ALLOWANCE (if Applicable) . . 2.

–

TOTAL SALES TAX DUE. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3.

=

ADD: INTEREST FOR LATE PAYMENT . . . . . . . . . . . . . . . . . . . . . . . 4.

+

ADD: ADDITIONS TO TAX . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5.

+

SUBTRACT: APPROVED CREDIT . . . . . . . . . . . . . . . . . . . . . . . . . . . 6.

–

PAY THIS AMOUNT (U.S. FUNDS ONLY) . . . . . . . . . . . . . . . . . . . . . 7.

=

PART A — ATTACH YOUR EXEMPT EQUIPMENT LISTING WITH KWH USAGE

(AND TAXABLE EQUIPMENT LISTING IF NECESSARY)

Estimated Hours

Hours Per

Weeks

Days

Estimated Hours

Number

Description of

Amp

Wattage

Wattage

KWH

Phase

Volts

HP

Day

Used Annually

Per

Per

Used Annually

Draws

from VA

from HP

Per Year

of Units

Exempt Electrical Equipment

(run-time)

X No. of Units

Year

Week

Per Unit

EXAMPLE

Attach a detailed listing

Total KWH

Please calculate the hours used on each piece of taxable equipment for the full calendar year. The calculations in Part A are for the purpose of calculating

the exemption under Section144.030.2 (12) RSMo. and should not take into account the additional exempt electricity under Section144.054.2 RSMo.

Section 144.030.2 (12) RSMo. exempts from state and local sales tax “electrical energy used in the actual primary manufacturing, processing,

compounding, mining or producing of a product, or electrical energy used in the actual secondary processing or fabricating of the product, or a material

recovery processing plant as defined in subdivision (4) of this subsection, in facilities owned or leased by the taxpayer, … if the total cost of electrical

energy so used exceeds ten percent of the total cost of production, either primary or secondary, exclusive of the cost of electrical energy so used.”

Section 144.054, RSMo, effective August 28, 2007, exempts from state sales tax "electrical energy used or consumed in the manufacturing, processing,

compounding, mining, or producing of any product or used or consumed in the processing of recovered materials ...." If total exempt electricity after taking

into account the additional exempt usage per Section 144.054 RSMo. is at least 76% of total usage, the electricity is 100% exempt from state tax.

Therefore, electricity that does not qualify for the state and local sales tax exemption under Section 144.030.2(12), RSMo is subject to local sales tax only.

PART B — COMPUTATION OF PERCENTAGE OF ELECTRICITY USED

PERCENTAGE

ESTIMATED USAGE

KWH

A. TOTAL ELECTRICITY USED (taken from

÷

suppliers bills)

A

100%

B. EXEMPT ELECTRICITY USED

B

(PART A TOTAL)

(B

÷

A)

(

C. TAXABLE ELECTRICITY USED

C

(A–B)

C

A)

MO 860-3039 (11-2010)

1

1 2

2 3

3