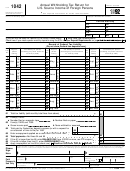

Instructions For Form 1042 - Annual Withholding Tax Return For U.s. Source Income Of Foreign Persons - 2012 Page 5

ADVERTISEMENT

designee chooses as his or her personal

must complete the entire form, including

criminal laws, or to federal law

identification number (PIN). The

all filing information for the calendar year,

enforcement and intelligence agencies to

authorization applies only to the tax form

and sign the return. Attach a statement

combat terrorism. If you fail to provide this

upon which it appears.

explaining why you are filing an amended

information in a timely manner, you may

return (for example, you are filing because

be liable for penalties and interest.

If you check the “Yes” box, you are

the tax liability for May was incorrectly

authorizing the IRS to call the designee to

You are not required to provide the

reported due to a mathematical error).

answer any questions relating to the

information requested on a form that is

information reported on your tax return.

subject to the Paperwork Reduction Act

If you also are amending Form(s)

You also are authorizing the designee to:

unless the form displays a valid OMB

1042-S, see Amended Returns in the

Exchange information concerning your

control number. Books or records relating

Form 1042-S instructions.

tax return with the IRS, and

to a form or its instructions must be

Request and receive written tax return

retained as long as their contents may

Do not amend Form 1042 to recover

information relating to your tax return,

become material in the administration of

taxes overwithheld in the prior year. For

including copies of specific notices,

any Internal Revenue law. Generally, tax

more information, see Adjustment for

correspondence, and account transcripts.

returns and return information are

Overwithholding, earlier.

confidential, as required by section 6103.

You are not authorizing the designee to

Privacy Act and Paperwork Reduction

receive any refund check, bind you to

The time needed to complete and file

Act Notice. We ask for the information on

anything (including additional tax liability),

these forms will vary depending on

this form to carry out the Internal Revenue

or otherwise represent you before the IRS.

individual circumstances. The estimated

laws of the United States. Sections 1441,

If you want to expand the designee’s

average time is: Recordkeeping, 10 hr.,

1442, and 1446 (for PTPs) require

authorization, see Pub. 947, Practice

31 min.; Learning about the law or the

withholding agents to report and pay over

Before the IRS and Power of Attorney.

form, 2 hr., 25 min.; Preparing the form,

to the IRS taxes withheld from certain U.S.

The authorization automatically expires

4 hr., 34 min.; and Copying, assembling,

source income of foreign persons. Form

one year from the due date (without any

and sending the form to the IRS, 32

1042 is used to report the amount of

extensions) for filing your 2012 Form

min.

withholding that must be paid over. Form

1042. If you or your designee desires to

1042-S is used to report the amount of

If you have comments concerning the

terminate the authorization, a written

income and withholding to the payee.

accuracy of these time estimates or

statement conveying your wish to revoke

Section 6109 requires you to provide your

suggestions for making this form simpler,

the authorization should be submitted to

identifying number on the return. Routine

we would be happy to hear from you. You

the IRS service center where the return

uses of this information include giving it to

can write to the Internal Revenue Service,

was processed.

the Department of Justice for civil and

Tax Products Coordinating Committee,

criminal litigation, and to cities, states, the

Amended Return

SE:W:CAR:MP:T:M:S, 1111 Constitution

District of Columbia, and U.S.

Ave. NW, IR-6526, Washington, DC

If you have to make changes to your Form

commonwealths and possessions for use

20224. Do not send the form to this

1042 after you submit it, file an amended

in administering their tax laws. We may

address. Instead, see Where and When

Form 1042. Use a Form 1042 for the year

also disclose this information to other

To File, earlier.

you are amending. Check the “Amended

countries under a tax treaty, to federal and

Return” box at the top of the form. You

state agencies to enforce federal nontax

Instructions for Form 1042

-5-

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5