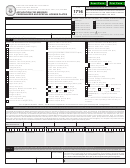

Form Lic1 Application For Tax Filing And Payment Status Report-Licensing Page 2

ADVERTISEMENT

INSTRUCTIONS FOR FORMS LIC 1 AND LIC 1A

Please print (except for the signature). Do not write with a pencil. Prepare this form in duplicate. Have one

of the copies stamped for your record. Save this copy for future reference. DO NOT SUBMIT A COPY OF THIS

APPLICATION TO LICENSING AND CONSUMER AFFAIRS. This form must be completed in its entirety before a

letter certifying tax filing and payment status can be issued.

You are required to complete and submit a notarized affidavit (Form LIC 1A) if you have not resided in the

Virgin Islands and have not filed your Federal Income Tax Returns for the three years prior to this application with

the Bureau, if you have been unemployed for the past three years or if you were attending school. CORPORATIONS

AND PARTNERSHIPS – List name, social security number and mailing address for corporate officers or partners. S

CORPORATIONS – Also list name, social security number, and mailing address for all shareholders.

ALL

INCOMEPLETE APPLICATIONS WILL BE REJECTED.

Specific Instructions

1.

Business Name: The name under which the business is conducted; it may be the same as or different to the

applicant’s name (i.e. John Smith (applicant) d/b/a Smith’s Construction (business name)) (d/b/a – doing

business as).

2.

Business EIN: Employer Identification Number, a 9-digit number issued by the Internal Revenue Service in

Philadelphia to partnerships, corporations and self-employed individuals who pay wages to one or more

employees.

3.

Owners SSN:

Social Security Number, a 9-digit number issued to an individual by the Social Security

Administration. Spouse SSN: also a 9-digit number.

4.

Type of License: Check one (1) to indicate whether this application is for a new license or a renewal license.

5.

Form of Business:

Check one (1) to indicate whether the business is organized as a Self Employed, a

Corporation, a Partnership, a Limited Liability Company or a Limited Liability Partnership.

6.

Do have any employees: Either answer yes or no on this line.

7.

Circle Forms that you use: 1120(Corporation), 1065(Partnership), 1040/8689(Individual), 941VI(Withholding

Tax), 720VI & 720B-VI (Gross Receipts Tax), 722VI (Hotel Room Tax).

8.

License Expiration Date: Date shown on your business license.

9. & 10. Person Representing the Applicant: If other than the applicant, a partner or a corporate officer, this

individual must attach a valid power of attorney (Form 2848) to receive the tax clearance letter.

11.

All applications must be signed.

12.

Mailing address is essential for proper delivery of tax clearance letter.

13 & 14. Physical Address is also required by licensing. Telephone No.: A daytime number is essential.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2