Exemption Certificate Form - 2008

ADVERTISEMENT

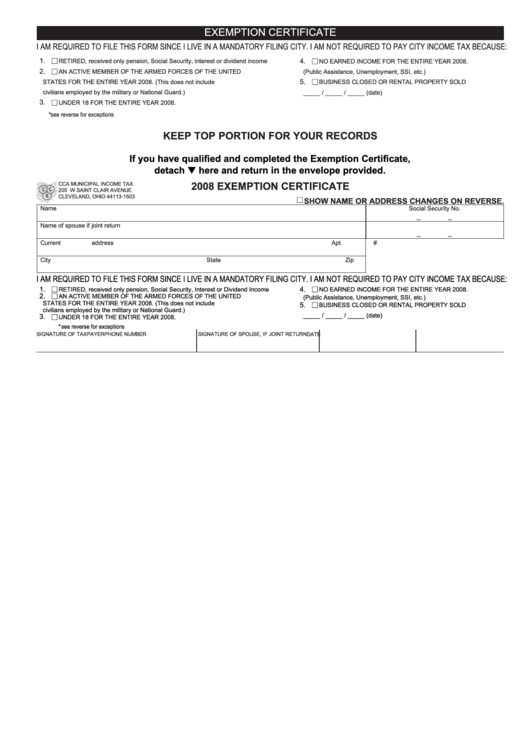

EXEMPTION CERTIFICATE

I AM REQUIRED TO FILE THIS FORM SINCE I LIVE IN A MANDATORY FILING CITY. I AM NOT REQUIRED TO PAY CITY INCOME TAX BECAUSE:

1.

4.

RETIRED, received only pension, Social Security, interest or dividend income

NO EARNED INCOME FOR THE ENTIRE YEAR 2008.

2.

AN ACTIVE MEMBER OF THE ARMED FORCES OF THE UNITED

(Public Assistance, Unemployment, SSI, etc.)

5.

STATES FOR THE ENTIRE YEAR 2008. (This does not include

BUSINESS CLOSED OR RENTAL PROPERTY SOLD

civilians employed by the military or National Guard.)

_____ / _____ / _____ (date)

3.

UNDER 18 FOR THE ENTIRE YEAR 2008.

*see reverse for exceptions

detach

CCA MUNICIPAL INCOME TAX

205 W SAINT CLAIR AVENUE

CLEVELAND, OHIO 44113-1503

Name

Social Security No.

–

–

Name of spouse if joint return

–

–

Current address

Apt. #

City

State

Zip

I AM REQUIRED TO FILE THIS FORM SINCE I LIVE IN A MANDATORY FILING CITY. I AM NOT REQUIRED TO PAY CITY INCOME TAX BECAUSE:

1.

4.

RETIRED, received only pension, Social Security, Interest or Dividend Income

NO EARNED INCOME FOR THE ENTIRE YEAR 2008.

2.

AN ACTIVE MEMBER OF THE ARMED FORCES OF THE UNITED

(Public Assistance, Unemployment, SSI, etc.)

STATES FOR THE ENTIRE YEAR 2008. (This does not include

5.

BUSINESS CLOSED OR RENTAL PROPERTY SOLD

civilians employed by the military or National Guard.)

_____ / _____ / _____ (date)

3.

UNDER 18 FOR THE ENTIRE YEAR 2008.

*see reverse for exceptions

SIGNATURE OF TAXPAYER

SIGNATURE OF SPOUSE, IF JOINT RETURN

PHONE NUMBER

DATE

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2