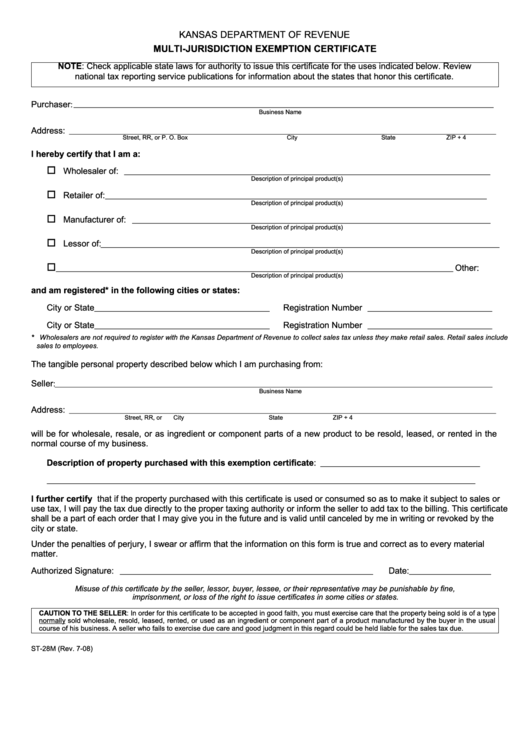

KANSAS DEPARTMENT OF REVENUE

MULTI-JURISDICTION EXEMPTION CERTIFICATE

NOTE: Check applicable state laws for authority to issue this certificate for the uses indicated below. Review

national tax reporting service publications for information about the states that honor this certificate.

Purchaser

_______________________________________________________________________________________________________________________

:

Business Name

Address:

_________________________________________________________________________________________________________________________

Street, RR, or P. O. Box

City

State

ZIP + 4

I hereby certify that I am a:

o

Wholesaler of: ______________________________________________________________________________________________

Description of principal product(s)

__________________________________________________________________________________________________

o

Retailer of:

Description of principal product(s)

o

____________________________________________________________________________________________

Manufacturer of:

Description of principal product(s)

o

Lessor of:

_____________________________________________________________________________________________________________________

Description of principal product(s)

o

______________________________________________________________________________________________________

Other:

Description of principal product(s)

and am registered* in the following cities or states:

Registration Number ________________________________

City or State_____________________________________________

Registration Number ________________________________

City or State_____________________________________________

* Wholesalers are not required to register with the Kansas Department of Revenue to collect sales tax unless they make retail sales. Retail sales include

sales to employees.

The tangible personal property described below which I am purchasing from:

Seller

: ____________________________________________________________________________________________________________________________

Business Name

Address:

_________________________________________________________________________________________________________________________

Street, RR, or P.O. Box

City

State

ZIP + 4

will be for wholesale, resale, or as ingredient or component parts of a new product to be resold, leased, or rented in the

normal course of my business.

Description of property purchased with this exemption certificate: _________________________________________

______________________________________________________________________________________________________________

I further certify that if the property purchased with this certificate is used or consumed so as to make it subject to sales or

use tax, I will pay the tax due directly to the proper taxing authority or inform the seller to add tax to the billing. This certificate

shall be a part of each order that I may give you in the future and is valid until canceled by me in writing or revoked by the

city or state.

Under the penalties of perjury, I swear or affirm that the information on this form is true and correct as to every material

matter.

Authorized Signature: _________________________________________________________________

Date:_____________________

Misuse of this certificate by the seller, lessor, buyer, lessee, or their representative may be punishable by fine,

imprisonment, or loss of the right to issue certificates in some cities or states.

CAUTION TO THE SELLER: In order for this certificate to be accepted in good faith, you must exercise care that the property being sold is of a type

normally sold wholesale, resold, leased, rented, or used as an ingredient or component part of a product manufactured by the buyer in the usual

course of his business. A seller who fails to exercise due care and good judgment in this regard could be held liable for the sales tax due.

ST-28M (Rev. 7-08)

1

1