Special Event Sales Tax Return Form - City And County Of Broomfield

ADVERTISEMENT

City and County of Broomfield

Sales Tax Administration

P.O. BOX 407

BROOMFIELD, CO 80038-0407

303-464-5811

303-410-3802 (fax)

Email:

Web:

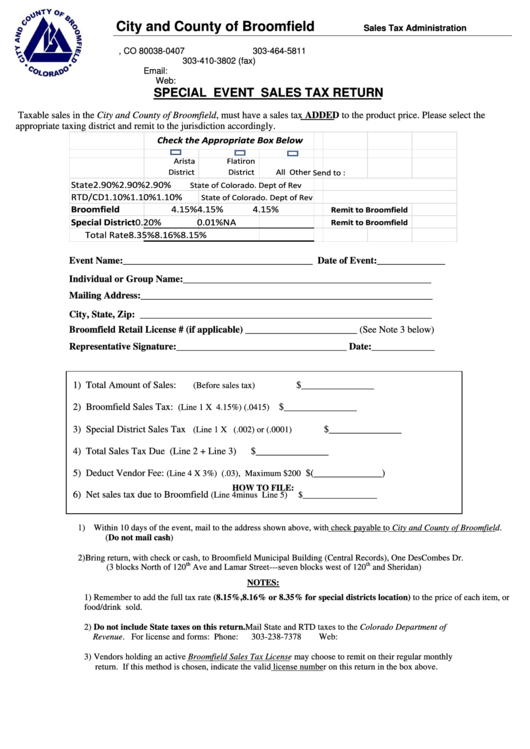

SPECIAL EVENT SALES TAX RETURN

Taxable sales in the City and County of Broomfield, must have a sales tax ADDED to the product price. Please select the

appropriate taxing district and remit to the jurisdiction accordingly.

Check the Appropriate Box Below

Arista

Flatiron

District

District

All Other

Send to :

State

2.90%

2.90%

2.90%

State of Colorado. Dept of Rev

RTD/CD

1.10%

1.10%

1.10%

State of Colorado. Dept of Rev

Broomfield

4.15%

4.15%

4.15%

Remit to Broomfield

Special District

0.20%

0.01%

NA

Remit to Broomfield

Total Rate

8.35%

8.16%

8.15%

Event Name:_______________________________________ Date of Event:______________

Individual or Group Name:___________________________________________________

Mailing Address:____________________________________________________________

City, State, Zip: ____________________________________________________________

Broomfield Retail License # (if applicable) _______________________ (See Note 3 below)

Representative Signature:___________________________________ Date:_____________

1) Total Amount of Sales:

$_______________

(Before sales tax)

2) Broomfield Sales Tax:

$_______________

(Line 1 X 4.15%) (.0415)

3) Special District Sales Tax

$_______________

(Line 1 X (.002) or (.0001)

4) Total Sales Tax Due (Line 2 + Line 3)

$_______________

5) Deduct Vendor Fee:

$(______________)

(Line 4 X 3%) (.03), Maximum $200

HOW TO FILE:

6) Net sales tax due to Broomfield

(Line 4 minus Line 5)

$_________________

1) Within 10 days of the event, mail to the address shown above, with check payable to City and County of Broomfield.

(Do not mail cash)

2) Bring return, with check or cash, to Broomfield Municipal Building (Central Records), One DesCombes Dr.

th

th

(3 blocks North of 120

Ave and Lamar Street---seven blocks west of 120

and Sheridan)

NOTES:

1) Remember to add the full tax rate (8.15%,8.16% or 8.35% for special districts location) to the price of each item, or

food/drink sold.

2) Do not include State taxes on this return. Mail State and RTD taxes to the Colorado Department of

Revenue. For license and forms: Phone:

303-238-7378

Web:

3) Vendors holding an active Broomfield Sales Tax License may choose to remit on their regular monthly

return. If this method is chosen, indicate the valid license number on this return in the box above.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1