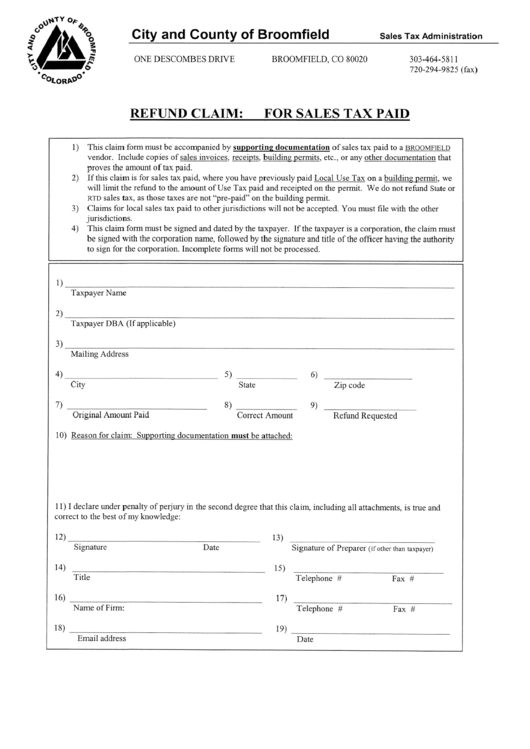

Refund Claim: For Sales Tax Paid Form - City And County Of Broomfield

ADVERTISEMENT

City and County of Broomfield

Sales Tax Administration

ONE DESCOMBES DRIVE

BROOMFIELD, CO 80020

303-464-5811

720-294-9825 (fax)

REFUND CLAIM :

FOR SALES TAX PAID

1)

This claim form must be accompanied by supporting documentation of sales tax paid to a

BROOMFIELD

vendor. Include copies of sales invoices , receipts , building_ permits , etc ., or any other documentation that

proves the amount of tax paid.

2)

If this claim is for sales tax paid, where you have previously paid Local Use Tax on a building_ permit, we

will limit the refund to the amount of Use Tax paid and receipted on the permit. We do not refund State or

RTD

sales tax, as those taxes are not "pre-paid" on the building permit.

3)

Claims for local sales tax paid to other jurisdictions will not be accepted . You must file with the other

jurisdictions.

4) This claim form must be signed and dated by the taxpayer. If the taxpayer is a corporation, the claim must

be signed with the corporation name, followed by the signature and title of the officer having the authority

to sign for the corporation. Incomplete forms will not be processed .

1)

Taxpayer Name

2)

Taxpayer DBA (If applicable)

3 )

Mailing Address

4)

5)

6)

City

State

Zip code

8)

9)

Original Amount Paid

Correct Amount

Refund Requested

10) Reason for claim: Supporting documentation must be attached :

11) I declare under penalty of perjury in the second degree that this claim, including all attachments, is true and

correct to the best of my knowledge :

12)

13)

Signature

Date

Signat ure of Preparer

(if other than taxpayer)

14)

15)

Title

Telephone #

Fax #

16)

17)

Name of Firm:

Te lephone #

Fax #

18)

19)

Email address

Date

I

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1