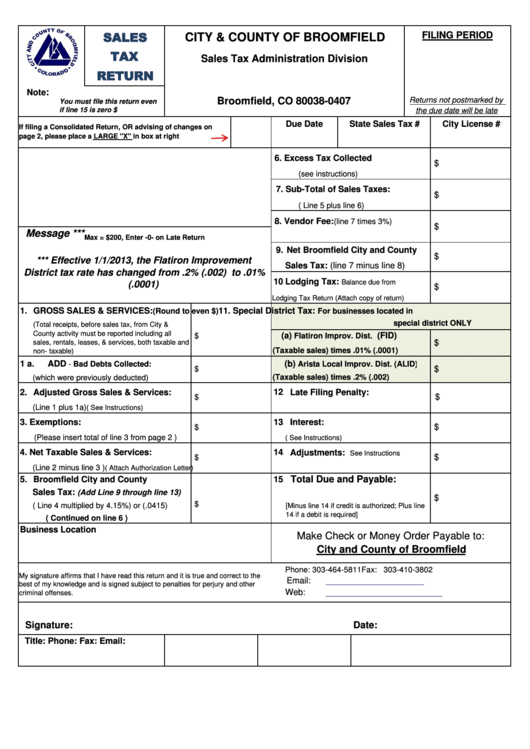

Sales Tax Return Form - City And County Of Broomfield

ADVERTISEMENT

SALES

FILING PERIOD

CITY & COUNTY OF BROOMFIELD

TAX

Sales Tax Administration Division

RETURN

P.O. Box 407

:

Note

Broomfield, CO 80038-0407

Returns not postmarked by

You must file this return even

the due date will be late

if line 15 is zero $

Due Date

State Sales Tax #

City License #

If filing a Consolidated Return, OR advising of changes on

page 2, please place a LARGE "X" in box at right

6. Excess Tax Collected

$

(see instructions)

7. Sub-Total of Sales Taxes:

$

( Line 5 plus line 6)

8. Vendor Fee:

(line 7 times 3%)

$

Message ***

Max = $200, Enter -0- on Late Return

9. Vendor Fee:

Net Broomfield City and County

$

*** Effective 1/1/2013, the Flatiron Improvement

Sales Tax: (line 7 minus line 8)

District tax rate has changed from .2% (.002) to .01%

10. Vendor Fee:

Lodging Tax:

Balance due from

(.0001)

$

Lodging Tax Return (Attach copy of return)

1. GROSS SALES & SERVICES:

11. Special District Tax:

(Round to even $)

For businesses located in

special district ONLY

(Total receipts, before sales tax, from City &

County activity must be reported including all

$

(a)

(FID)

Flatiron Improv. Dist.

$

sales, rentals, leases, & services, both taxable and

(Taxable sales) times .01% (.0001)

non- taxable)

1 a.

ADD

(b)

- Bad Debts Collected:

Arista Local Improv. Dist. (ALID)

$

$

(which were previously deducted)

(Taxable sales) times .2% (.002)

2. Adjusted Gross Sales & Services:

12. Vendor Fee:

Late Filing Penalty:

$

$

(Line 1 plus 1a)

( See Instructions)

3. Exemptions:

13. Vendor Fee:

Interest:

$

$

(Please insert total of line 3 from page 2 )

( See Instructions)

4. Net Taxable Sales & Services:

14. Adjustments:

Adjustments:

See Instructions

$

$

(Line 2 minus line 3 )

( Attach Authorization Letter)

Total Due and Payable:

5. Broomfield City and County

15. Adjustments:

Sales Tax:

(Add Line 9 through line 13)

$

$

( Line 4 multiplied by 4.15%) or (.0415)

[Minus line 14 if credit is authorized; Plus line

14 if a debit is required]

( Continued on line 6 )

Business Location

Make Check or Money Order Payable to:

City and County of Broomfield

Phone:

303-464-5811

Fax: 303-410-3802

My signature affirms that I have read this return and it is true and correct to the

Email:

best of my knowledge and is signed subject to penalties for perjury and other

Web:

criminal offenses.

Signature:

Date:

Title:

Phone:

Fax:

Email:

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2