2002 Idle Equipment, Obsolete Equipment, And Surplus Equipment Report Form - Michigan Department Of Treasury

ADVERTISEMENT

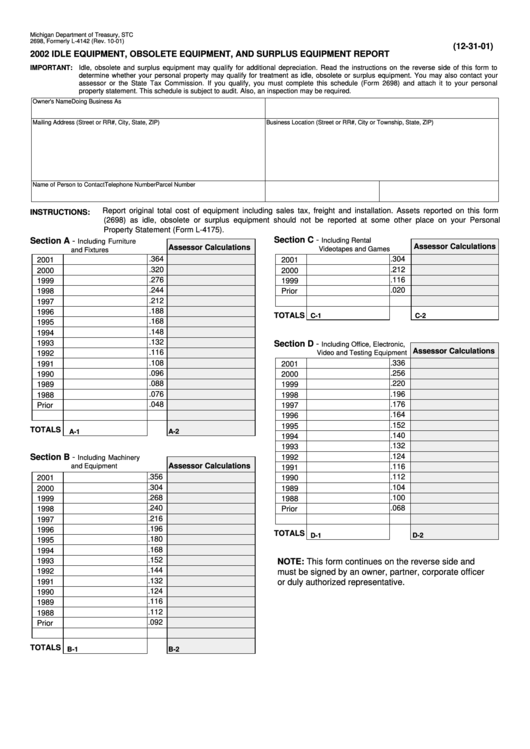

Michigan Department of Treasury, STC

2698, Formerly L-4142 (Rev. 10-01)

(12-31-01)

2002 IDLE EQUIPMENT, OBSOLETE EQUIPMENT, AND SURPLUS EQUIPMENT REPORT

IMPORTANT:

Idle, obsolete and surplus equipment may qualify for additional depreciation. Read the instructions on the reverse side of this form to

determine whether your personal property may qualify for treatment as idle, obsolete or surplus equipment. You may also contact your

assessor or the State Tax Commission. If you qualify, you must complete this schedule (Form 2698) and attach it to your personal

property statement. This schedule is subject to audit. Also, an inspection may be required.

Owner's Name

Doing Business As

Mailing Address (Street or RR#, City, State, ZIP)

Business Location (Street or RR#, City or Township, State, ZIP)

Name of Person to Contact

Telephone Number

Parcel Number

Report original total cost of equipment including sales tax, freight and installation. Assets reported on this form

INSTRUCTIONS:

(2698) as idle, obsolete or surplus equipment should not be reported at some other place on your Personal

Property Statement (Form L-4175).

Section C -

Section A -

Including Rental

Including Furniture

Assessor Calculations

Assessor Calculations

Videotapes and Games

and Fixtures

.364

.304

2001

2001

.320

.212

2000

2000

.276

.116

1999

1999

.244

.020

1998

Prior

.212

1997

.188

1996

TOTALS

C-1

C-2

.168

1995

.148

1994

.132

1993

Section D -

Including Office, Electronic,

Assessor Calculations

.116

Video and Testing Equipment

1992

.108

.336

1991

2001

.096

.256

1990

2000

.088

.220

1989

1999

.076

.196

1988

1998

.048

.176

Prior

1997

.164

1996

.152

1995

TOTALS

A-1

A-2

.140

1994

.132

1993

.124

Section B -

1992

Including Machinery

Assessor Calculations

and Equipment

.116

1991

.356

.112

2001

1990

.304

.104

2000

1989

.268

.100

1999

1988

.240

.068

1998

Prior

.216

1997

.196

1996

TOTALS

D-1

D-2

.180

1995

.168

1994

.152

1993

NOTE: This form continues on the reverse side and

.144

1992

must be signed by an owner, partner, corporate officer

.132

1991

or duly authorized representative.

.124

1990

.116

1989

.112

1988

.092

Prior

TOTALS

B-1

B-2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2