Annual Statement Pursuant To 11 U.s.c. 521(F) And (G)

ADVERTISEMENT

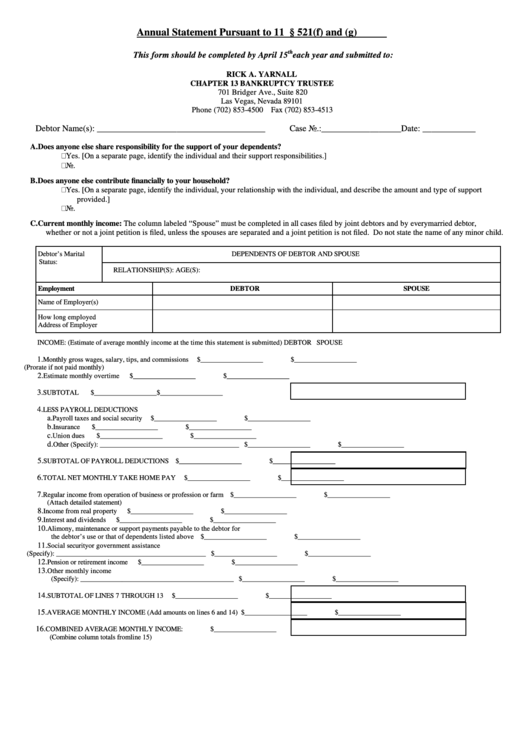

Annual Statement Pursuant to 11 U.S.C. § 521(f) and (g)

th

This form should be completed by April 15

each year and submitted to:

RICK A. YARNALL

CHAPTER 13 BANKRUPTCY TRUSTEE

701 Bridger Ave., Suite 820

Las Vegas, Nevada 89101

Phone (702) 853-4500 Fax (702) 853-4513

Debtor Name(s): ______________________________________

Case No.: __________________

Date: ____________

A. Does anyone else share responsibility for the support of your dependents?

Yes. [On a separate page, identify the individual and their support responsibilities.]

No.

B.

Does anyone else contribute financially to your household?

Yes. [On a separate page, identify the individual, your relationship with the individual, and describe the amount and type of support

provided.]

No.

C. Current monthly income: The column labeled “Spouse” must be completed in all cases filed by joint debtors and by every married debtor,

whether or not a joint petition is filed, unless the spouses are separated and a joint petition is not filed. Do not state the name of any minor child.

Debtor’s Marital

DEPENDENTS OF DEBTOR AND SPOUSE

Status:

RELATIONSHIP(S):

AGE(S):

Employment

DEBTOR

SPOUSE

Name of Employer(s)

How long employed

Address of Employer

INCOME: (Estimate of average monthly income at the time this statement is submitted)

DEBTOR

SPOUSE

1.

Monthly gross wages, salary, tips, and commissions

$__________________

$__________________

(Prorate if not paid monthly)

2.

Estimate monthly overtime

$__________________

$__________________

3.

SUBTOTAL

$__________________

$__________________

4.

LESS PAYROLL DEDUCTIONS

a.

Payroll taxes and social security

$__________________

$__________________

b.

Insurance

$__________________

$__________________

c.

Union dues

$__________________

$__________________

d.

Other (Specify): ________________________________________

$__________________

$__________________

5.

SUBTOTAL OF PAYROLL DEDUCTIONS

$__________________

$__________________

6.

TOTAL NET MONTHLY TAKE HOME PAY

$__________________

$__________________

7.

Regular income from operation of business or profession or farm

$__________________

$__________________

(Attach detailed statement)

8.

Income from real property

$__________________

$__________________

9.

Interest and dividends

$__________________

$__________________

10.

Alimony, maintenance or support payments payable to the debtor for

the debtor’s use or that of dependents listed above

$__________________

$__________________

11.

Social security or government assistance

(Specify): ___________________________________________

$__________________

$__________________

12.

Pension or retirement income

$__________________

$__________________

13.

Other monthly income

(Specify): _____________________________________________

$__________________

$__________________

14.

SUBTOTAL OF LINES 7 THROUGH 13

$__________________

$__________________

15.

AVERAGE MONTHLY INCOME (Add amounts on lines 6 and 14)

$__________________

$__________________

16.

COMBINED AVERAGE MONTHLY INCOME:

$__________________

(Combine column totals from line 15)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2