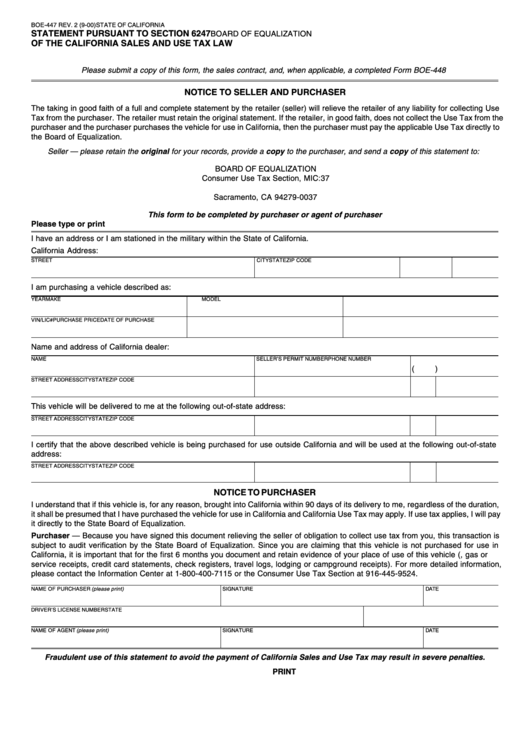

BOE-447 REV. 2 (9-00)

STATE OF CALIFORNIA

STATEMENT PURSUANT TO SECTION 6247

BOARD OF EQUALIZATION

OF THE CALIFORNIA SALES AND USE TAX LAW

Please submit a copy of this form, the sales contract, and, when applicable, a completed Form BOE-448

NOTICE TO SELLER AND PURCHASER

The taking in good faith of a full and complete statement by the retailer (seller) will relieve the retailer of any liability for collecting Use

Tax from the purchaser. The retailer must retain the original statement. If the retailer, in good faith, does not collect the Use Tax from the

purchaser and the purchaser purchases the vehicle for use in California, then the purchaser must pay the applicable Use Tax directly to

the Board of Equalization.

Seller — please retain the original for your records, provide a copy to the purchaser, and send a copy of this statement to:

BOARD OF EQUALIZATION

Consumer Use Tax Section, MIC:37

P.O. Box 942879

Sacramento, CA 94279-0037

This form to be completed by purchaser or agent of purchaser

Please type or print

I have an address or I am stationed in the military within the State of California.

California Address:

STREET

CITY

STATE

ZIP CODE

I am purchasing a vehicle described as:

YEAR

MAKE

MODEL

VIN/LIC#

PURCHASE PRICE

DATE OF PURCHASE

Name and address of California dealer:

NAME

SELLER’S PERMIT NUMBER

PHONE NUMBER

(

)

STREET ADDRESS

CITY

STATE

ZIP CODE

This vehicle will be delivered to me at the following out-of-state address:

STREET ADDRESS

CITY

STATE

ZIP CODE

I certify that the above described vehicle is being purchased for use outside California and will be used at the following out-of-state

address:

STREET ADDRESS

CITY

STATE

ZIP CODE

NOTICE TO PURCHASER

I understand that if this vehicle is, for any reason, brought into California within 90 days of its delivery to me, regardless of the duration,

it shall be presumed that I have purchased the vehicle for use in California and California Use Tax may apply. If use tax applies, I will pay

it directly to the State Board of Equalization.

Purchaser — Because you have signed this document relieving the seller of obligation to collect use tax from you, this transaction is

subject to audit verification by the State Board of Equalization. Since you are claiming that this vehicle is not purchased for use in

California, it is important that for the first 6 months you document and retain evidence of your place of use of this vehicle (i.e., gas or

service receipts, credit card statements, check registers, travel logs, lodging or campground receipts). For more detailed information,

please contact the Information Center at 1-800-400-7115 or the Consumer Use Tax Section at 916-445-9524.

NAME OF PURCHASER (please print)

SIGNATURE

DATE

DRIVER’S LICENSE NUMBER

STATE

NAME OF AGENT (please print)

SIGNATURE

DATE

Fraudulent use of this statement to avoid the payment of California Sales and Use Tax may result in severe penalties.

CLEAR

PRINT

1

1