Form Et 6.01 - Appraisement Of The Estate For Decedents Dying On Or After July 13, 2001 Page 2

ADVERTISEMENT

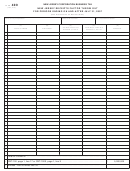

pArt 4: inVentory of probAte Assets – trAnsfers by Will or intestAcy

After completing PART 4, enter the total from each schedule on the appropriate line in PART 3.

scheDule A: Describe any real estate or any interest in real estate.

AssesseD

ApprAiseD

Include description and appraised value of out of state property, but do not

VAlue

VAlue

include this amount in the total. See page 3 of the instructions.

totAl (enter the total appraised value on line 1 of PART 3)

ApprAiseD

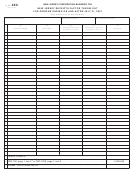

scheDule b: Tangible personal property of every kind. See page 3 of the instructions.

VAlue

totAl (enter the total appraised value on line 2 of PART 3)

ApprAiseD

scheDule c: Bonds and securities of every kind. See page 3 of the instructions.

VAlue

totAl (enter the total appraised value on line 3 of PART 3)

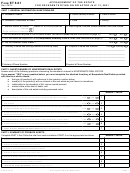

Form ET 6.01

West Virginia State Tax Department

Page 2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5