Form Av-9a - Certification Of Disability Under N.c.g.s. 105-277.1

ADVERTISEMENT

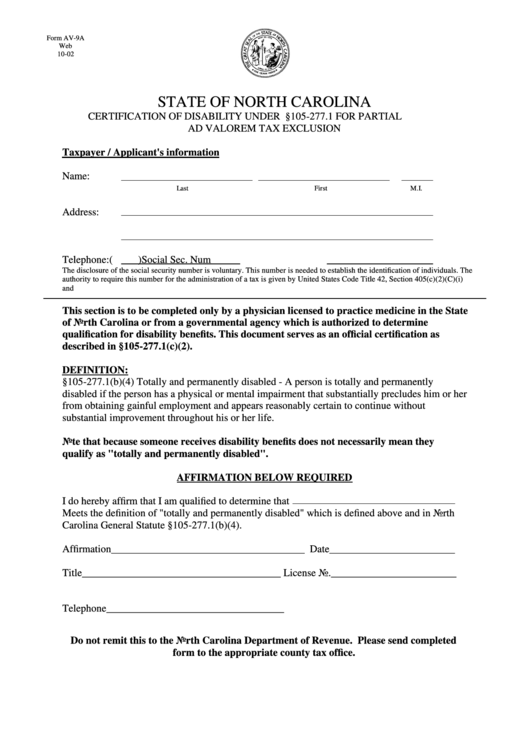

Form AV-9A

Web

10-02

STATE OF NORTH CAROLINA

CERTIFICATION OF DISABILITY UNDER N.C.G.S. §105-277.1 FOR PARTIAL

AD VALOREM TAX EXCLUSION

Taxpayer / Applicant's information

Name:

Last

First

M.I.

Address:

Telephone:

(

)

Social Sec. Num

The disclosure of the social security number is voluntary. This number is needed to establish the identification of individuals. The

authority to require this number for the administration of a tax is given by United States Code Title 42, Section 405(c)(2)(C)(i)

and N.C.G.S. 105-309

This section is to be completed only by a physician licensed to practice medicine in the State

of North Carolina or from a governmental agency which is authorized to determine

qualification for disability benefits. This document serves as an official certification as

described in §105-277.1(c)(2).

DEFINITION:

§105-277.1(b)(4) Totally and permanently disabled - A person is totally and permanently

disabled if the person has a physical or mental impairment that substantially precludes him or her

from obtaining gainful employment and appears reasonably certain to continue without

substantial improvement throughout his or her life.

Note that because someone receives disability benefits does not necessarily mean they

qualify as "totally and permanently disabled".

AFFIRMATION BELOW REQUIRED

I do hereby affirm that I am qualified to determine that

Meets the definition of "totally and permanently disabled" which is defined above and in North

Carolina General Statute §105-277.1(b)(4).

Affirmation_____________________________________ Date________________________

Title______________________________________ License No.________________________

Telephone__________________________________

Do not remit this to the North Carolina Department of Revenue. Please send completed

form to the appropriate county tax office.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1