Application For Homestead Exclusion Under N.c.g.s. 105-277.1 - North Carolina Department Of Revenue - 2004

ADVERTISEMENT

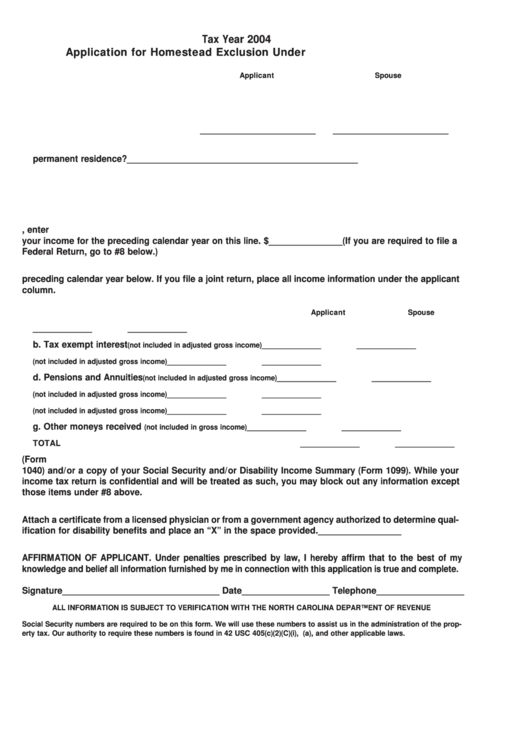

Tax Year 2004

Application for Homestead Exclusion Under N.C.G.S. 105-277.1

Applicant

Spouse

1. Full name as shown on listing card

_________________________

_________________________

2. Residence address

_________________________

_________________________

_________________________

_________________________

3. Is this property your

permanent residence?

_________________________

_________________________

4. Date of birth

_________________________

_________________________

5. Social Security number

_________________________

_________________________

6. Telephone number

_________________________

_________________________

7. If your income level is low enough that you are not required to file a Federal Income Tax Return, enter

your income for the preceding calendar year on this line. $ ________________(If you are required to file a

Federal Return, go to #8 below.)

8. Enter below the required income information from your individual Federal Income Tax Returns for the

preceding calendar year below. If you file a joint return, place all income information under the applicant

column.

Applicant

Spouse

a. Adjusted Gross Income

______________

______________

b. Tax exempt interest

______________

______________

(not included in adjusted gross income)

c. IRA distributions

______________

______________

(not included in adjusted gross income)

d. Pensions and Annuities

______________

______________

(not included in adjusted gross income)

e. Social Security Benefits

______________

______________

(not included in adjusted gross income)

f. Capital gains

______________

______________

(not included in adjusted gross income)

g. Other moneys received

______________

______________

(not included in gross income)

TOTAL

______________

______________

9. You should attach a copy of the first page of your Individual Federal Income Tax Return for 2003 (Form

1040) and/or a copy of your Social Security and/or Disability Income Summary (Form 1099). While your

income tax return is confidential and will be treated as such, you may block out any information except

those items under #8 above.

10. Disabled applicants under 65 years of age as of January 1 must furnish proof of their disability.

Attach a certificate from a licensed physician or from a government agency authorized to determine qual-

ification for disability benefits and place an “X” in the space provided.__________________

AFFIRMATION OF APPLICANT. Under penalties prescribed by law, I hereby affirm that to the best of my

knowledge and belief all information furnished by me in connection with this application is true and complete.

Signature__________________________________ Date___________________ Telephone___________________

ALL INFORMATION IS SUBJECT TO VERIFICATION WITH THE NORTH CAROLINA DEPARTMENT OF REVENUE

Social Security numbers are required to be on this form. We will use these numbers to assist us in the administration of the prop-

erty tax. Our authority to require these numbers is found in 42 USC 405(c)(2)(C)(i), N.C.G.S. 105-296(a), and other applicable laws.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1