Colorado Special District Sales Tax Return Form - Department Of Revenue

ADVERTISEMENT

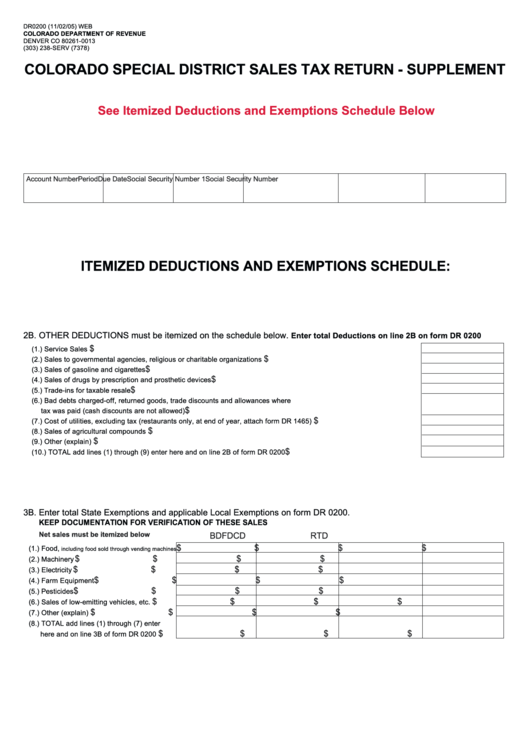

DR 0200 (11/02/05) WEB

COLORADO DEPARTMENT OF REVENUE

DENVER CO 80261-0013

(303) 238-SERV (7378)

COLORADO SPECIAL DISTRICT SALES TAX RETURN - SUPPLEMENT

See Itemized Deductions and Exemptions Schedule Below

Account Number

Period

Due Date

Social Security Number 1

Social Security Number 2

F.E.I.N.

ITEMIZED DEDUCTIONS AND EXEMPTIONS SCHEDULE:

2B. OTHER DEDUCTIONS must be itemized on the schedule below.

Enter total Deductions on line 2B on form DR 0200

$

(1.) Service Sales ............................................................................................................................................................................

$

(2.) Sales to governmental agencies, religious or charitable organizations ..................................................................................

$

(3.) Sales of gasoline and cigarettes ..............................................................................................................................................

$

(4.) Sales of drugs by prescription and prosthetic devices ............................................................................................................

$

(5.) Trade-ins for taxable resale ......................................................................................................................................................

(6.) Bad debts charged-off, returned goods, trade discounts and allowances where

$

tax was paid (cash discounts are not allowed) ..........................................................................................................................

$

(7.) Cost of utilities, excluding tax (restaurants only, at end of year, attach form DR 1465) .........................................................

$

(8.) Sales of agricultural compounds ..............................................................................................................................................

$

(9.) Other (explain) .........................................................................................................................................................................

$

(10.) TOTAL add lines (1) through (9) enter here and on line 2B of form DR 0200 .......................................................................

3B. Enter total State Exemptions and applicable Local Exemptions on form DR 0200.

KEEP DOCUMENTATION FOR VERIFICATION OF THESE SALES

Net sales must be itemized below

BD

FD

CD

RTD

$

$

$

$

(1.) Food,

including food sold through vending machines

$

$

$

$

(2.) Machinery ....................................................

$

$

$

$

(3.) Electricity .....................................................

$

$

$

$

(4.) Farm Equipment .........................................

$

$

$

$

(5.) Pesticides ....................................................

$

$

$

$

(6.) Sales of low-emitting vehicles, etc. ............

$

$

$

$

(7.) Other (explain) ............................................

(8.) TOTAL add lines (1) through (7) enter

$

$

$

$

here and on line 3B of form DR 0200 .........

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2