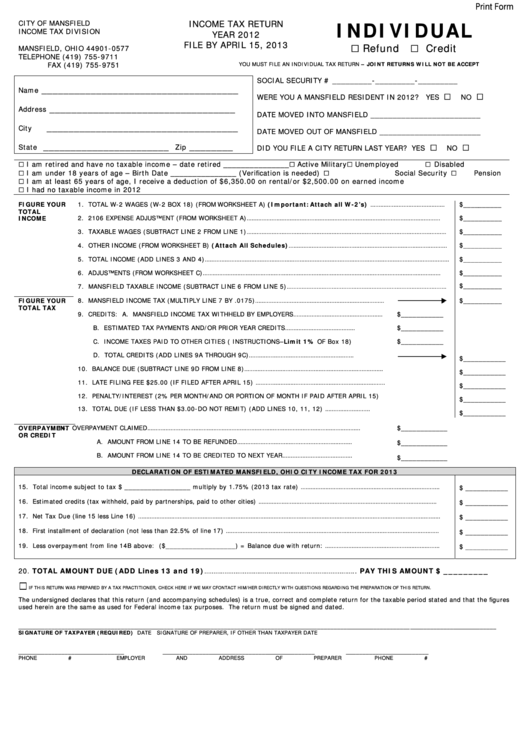

Print Form

CITY OF MANSFIELD

INCOME TAX RETURN

INDIVIDUAL

INCOME TAX DIVISION

YEAR 2012

P.O. BOX 577

FILE BY APRIL 15, 2013

G Refund

G Credit

MANSFIELD, OHIO 44901-0577

TELEPHONE (419) 755-9711

FAX (419) 755-9751

YOU MUST FILE AN INDIVIDUAL TAX RETURN – JOINT RETURNS WILL NOT BE ACCEPT

SOCIAL SECURITY # _________-_________-_________

____________________________________

Name

WERE YOU A MANSFIELD RESIDENT IN 2012?

YES

G

NO

G

__________________________________

Address

DATE MOVED INTO MANSFIELD _________________________

___________________________________

City

DATE MOVED OUT OF MANSFIELD _______________________

_______________________

________

State

Zip

DID YOU FILE A CITY RETURN LAST YEAR? YES

G

NO

G

G I am retired and have no taxable income – date retired _______________

G Active Military

G Unemployed

G Disabled

G I am under 18 years of age – Birth Date _______________ (Verification is needed)

G Social Security

G Pension

G I am at least 65 years of age, I receive a deduction of $6,350.00 on rental/or $2,500.00 on earned income

G I had no taxable income in 2012

FIGURE YOUR

1. TOTAL W-2 WAGES (W-2 BOX 18) (FROM WORKSHEET A) (Important: Attach all W-2’s) ………………………………………

$__________

TOTAL

2. 2106 EXPENSE ADJUSTMENT (FROM WORKSHEET A)………………………………………………………………………………………………………

$__________

INCOME

3. TAXABLE WAGES (SUBTRACT LINE 2 FROM LINE 1)…………………………………………………………………………………………………………

$__________

4. OTHER INCOME (FROM WORKSHEET B) (Attach All Schedules)……………………………………………………………………………………

$__________

5. TOTAL INCOME (ADD LINES 3 AND 4)…………………………………………………………………………………………………………………………………

$__________

6. ADJUSTMENTS (FROM WORKSHEET C)………………………………………………………………………………………………………………………………

$__________

7. MANSFIELD TAXABLE INCOME (SUBTRACT LINE 6 FROM LINE 5)……………………………………………………………………………………

$__________

FIGURE YOUR

8. MANSFIELD INCOME TAX (MULTIPLY LINE 7 BY .0175)……………………………………………………………………

$__________

TOTAL TAX

9. CREDITS: A. MANSFIELD INCOME TAX WITHHELD BY EMPLOYERS………………………………………………

$___________

B. ESTIMATED TAX PAYMENTS AND/OR PRIOR YEAR CREDITS……………………………………

$___________

C. INCOME TAXES PAID TO OTHER CITIES ( INSTRUCTIONS–Limit 1% OF Box 18)

$___________

D. TOTAL CREDITS (ADD LINES 9A THROUGH 9C)………………………………………………………

$___________

10. BALANCE DUE (SUBTRACT LINE 9D FROM LINE 8)…………………………………………………………………………

$___________

11. LATE FILING FEE $25.00 (IF FILED AFTER APRIL 15) ……………………………………………………………………

$___________

12. PENALTY/INTEREST (2% PER MONTH/AND OR PORTION OF MONTH IF PAID AFTER APRIL 15)

$___________

13. TOTAL DUE (IF LESS THAN $3.00-DO NOT REMIT) (ADD LINES 10, 11, 12) ………………………

$___________

OVERPAYMENT

14. OVERPAYMENT CLAIMED…………………………………………………………………………………………………………………

$____________

OR CREDIT

A. AMOUNT FROM LINE 14 TO BE REFUNDED……………………………………………………………

$____________

B. AMOUNT FROM LINE 14 TO BE CREDITED TO NEXT YEAR……………………………………

$____________

DECLARATION OF ESTIMATED MANSFIELD, OHIO CITY INCOME TAX FOR 2013

15. Total income subject to tax $ _________________ multiply by 1.75% (2013 tax rate) …………………………………………………………………………

$ ___________

16. Estimated credits (tax withheld, paid by partnerships, paid to other cities) ………………………………………………………………………………………………

$ ___________

17. Net Tax Due (line 15 less Line 16) …………………………………………………………………………………………………………………………………………………………………

$ ___________

18. First installment of declaration (not less than 22.5% of line 17) …………………………………………………………………………………………………………………

$ ___________

19. Less overpayment from line 14B above: ($__________________) = Balance due with return: ……………………………………………………………

$ ___________

20. TOTAL AMOUNT DUE (ADD Lines 13 and 19)……………………………………………………………………….. PAY THIS AMOUNT

$ _________

IF THIS RETURN WAS PREPARED BY A TAX PRACTITIONER, CHECK HERE IF WE MAY CFONTACT HIM/HER DIRECTLY WITH QUESTIONS REGARDING THE PREPARATION OF THIS RETURN.

The undersigned declares that this return (and accompanying schedules) is a true, correct and complete return for the taxable period stated and that the figures

used herein are the same as used for Federal income tax purposes. The return must be signed and dated.

_______________________________________________ ________________________

_______________________________________________ __________________________

SIGNATURE OF TAXPAYER (REQUIRED)

DATE

SIGNATURE OF PREPARER, IF OTHER THAN TAXPAYER

DATE

________________________________

______________________________________________ _________________________

PHONE #

EMPLOYER AND ADDRESS OF PREPARER

PHONE #

1

1 2

2