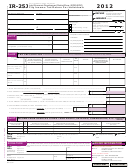

WORKSHEET A – SALARIES AND WAGES (W2 INCOME)

Column 1

Column 2

Column 3

Column 4

Column 5 (B)

Income From

2106

Mansfield Tax

Other City Tax

Employer, City, State

Each W-2-Box 18

Expenses Adj.

Withheld

Withheld

A.

B.

C.

D.

Totals

(A) 2106 expenses can only be used if used federally. To calculate the acceptable adjustment (Column3), use line 10 of Form 2106 minus

2% of line 38 of Form 1040. Please include a copy of Federal Forms 2106, 1040, and Schedule A for documentation. Income reduced by

this 2106 adjustment and (B) Other City Tax Withheld (Column 5) cannot exceed 1% of income from each W-2 (Column 2).

WORKSHEET B – OTHER INCOME

1. Schedule C (If taxes paid to other cities, attach other cities’ returns)

(Attach copy of Schedule C)

(A)

(B)

(C)

(D)

(C times D)

Net Profit/

Allocation

Amount

Business Name

Business Address

(Loss)

Percentage

Subject to Tax

A.

B.

TOTAL (1)

$___________________

2. Schedule C – Income From Rents (Attach Federal Schedule E)

TOTAL (2) $ ___________________

3. Schedule O – Other Income Not Included in Schedules C or E (Attach Federal Schedules)

Income from Partnerships, Estates, Trusts, Fees, Tips, 1099’S, etc.

Received From Name/ID#

For (Description and/or Location)

Amount

A.

B.

TOTAL (3) $ ___________________

TOTAL OTHER INCOME (ADD LINES 1 – 3) ENTER ON LINE 4 OF RETURN

TOTAL

$ ___________________

NOTE:

The net loss from an unincorporated business activity may not be used to offset salaries, wages, commissions or other

compensation. However, if a taxpayer is engaged in two or more taxable business activities to be included on the same return, the net

loss of one unincorporated business activity may be used to offset the profits of another for purposes of arriving at overall net profits.

(Final Return Line 4 cannot be less than zero, if you have W-2 income)

WORKSHEET C – ADJUSTMENTS TO INCOME (Part year residents, credits for taxpayers 65 and older,

income not subject to tax, etc.)

Explanation

Deductions

Net Adjustment (enter on Final Return Line 6)

ATTACHMENTS REQUIRED WITH ALL RETURNS: W-2’S AND FEDERAL SCHEDULES

IMPORTANT: It is mandatory to file a declaration of estimated taxes and make estimated payments, also please read instructions on

who must file and what is taxable or non-taxable income.

1

1 2

2