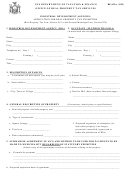

Form Idr 57-122a - Application For Industrial Property Tax Exemption Page 2

ADVERTISEMENT

NOTICE: An applicant may submit a plan for new construction to the city council or board of supervisors

prior to completing this application in order to obtain prior approval for property tax exemption eligibility.

Enter the name and address of the property owner claiming exemption.

Enter the address of the property for which an exemption is being claimed.

Enter how property is assessed and used or intended to be used as.

Item 1: New construction means new buildings and structures, including new additions to existing buildings

and structures. You are required to present an accurate and detailed description of the new construction, the date

construction began or will begin, the anticipated date the construction will be completed, and the cost of the

entire new construction project. Attach additional pages if necessary.

Item 2: Reconstruction of existing buildings is not eligible for a property tax exemption unless the following

conditions are met:

(a) Reconstruction is required due to economic obsolescence.

(b) Reconstruction is necessary to implement recognized industry standards for the manufacturing and

processing of specific products.

(c) Reconstruction is required to continue to competitively manufacture or process specific products.

IMPORTANT: Reconstruction must meet the above conditions and written approval must be received from the

county board of supervisors or city council prior to submitting this application to your assessor. The written

approval is to be attached to the application form.

If prior approval has been granted, complete Item 2 on the application by attaching a detailed description of the

type of building being reconstructed, the exact nature of the reconstruction, the date reconstruction began or will

begin, and the cost of the entire reconstruction project. Attach additional pages if necessary.

This application must be signed by the property owner and submitted to the city or county assessor in which the

property is located no later than February 1 of the year in which the property claimed for exemption is first

assessed for tax purposes. However, a single application may be filed upon completion of an entire project

requiring more than one year to construct or complete providing prior approval has been granted by the city

council of county board of supervisors.

IDR 57-122b (06/15/15)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2