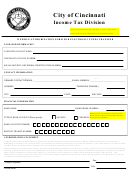

WORKSHEET A - SALARIES, WAGES, TIPS, AND OTHER COMPENSATION

(To be completed by taxpayers who receive W-2 income from more than one source.)

**Enclose copies of all W-2s used to compute your local income.**

Qualifying Wages

Cincinnati Tax Withheld

Other City Tax Withheld

Employer

City Where Employed

(Box 5 on W-2)

(Box 19 on W-2)

(Box 19 on W-2)

Totals

(Enter Total Qualifying Wages on Line 1, Page 1)

WORKSHEET B - BUSINESS INCOME or LOSS

**Enclose copies of all Federal Forms and Schedules used to compute your local income. **

Column A

Column B

Cincinnati Taxable Income

Income / (Loss)

Cincinnati

Schedules

(Column A x Column B

from Federal

Percentage

for lines 1 through 4)

Schedules

Schedule C - Business Income

(Step 5 of Schedule Y)

$

$

(A separate allocation schedule is required for each

Schedule C).

1.

Schedule E - Rental Income

(Residents enter profit/loss from all properties.

$

$

Nonresidents enter only profit/loss from Cincinnati

100.00 %

2.

properties)

Schedule K-1 - Partnership Income

$

$

(Residents enter profit/loss from entities that do not

100.00 %

3.

withhold Cincinnati tax on entire distributive share)

(Step 5 of Schedule Y)

Miscellaneous Income – Other Income

$

$

including

1099-MISC, W-2G & Schedule F.

4.

%

Net Operating Loss Claimed to Offset Current Year Business Income

$

(Enclose a worksheet showing prior year losses for up to 5 years and amounts previously claimed.)

5.

(Enter the amount claimed as a (deduction))

$

Total Income (Loss)

(Combine Lines 1 through 5 and enter this amount on Page 1, Line 6)

6.

SCHEDULE Y - BUSINESS APPORTIONMENT FORMULA

(To be completed by all nonresidents who earn a portion of their net profits in Cincinnati.)

a. Located

b. Located in

c. Percentage (b/a)

Everywhere

Cincinnati

STEP 1.

Average Original Cost of Real and Tangible Personal Property.

Gross Annual Rent Paid Multiplied by 8…………………………

TOTAL STEP 1……………………..……………………………..

STEP 2.

Wages, Salaries, and Other Compensation Paid…………….

Gross Receipts from Sales Made and/or Work or Services

STEP 3.

Performed…………………………………………………………

STEP 4.

Total Percentages. (Add Percentages from Steps 1-3)………

STEP 5.

Apportionment Percentage (Divide Total Percentage by Number of Percentages Used)………………………………

TOL

1

1 2

2